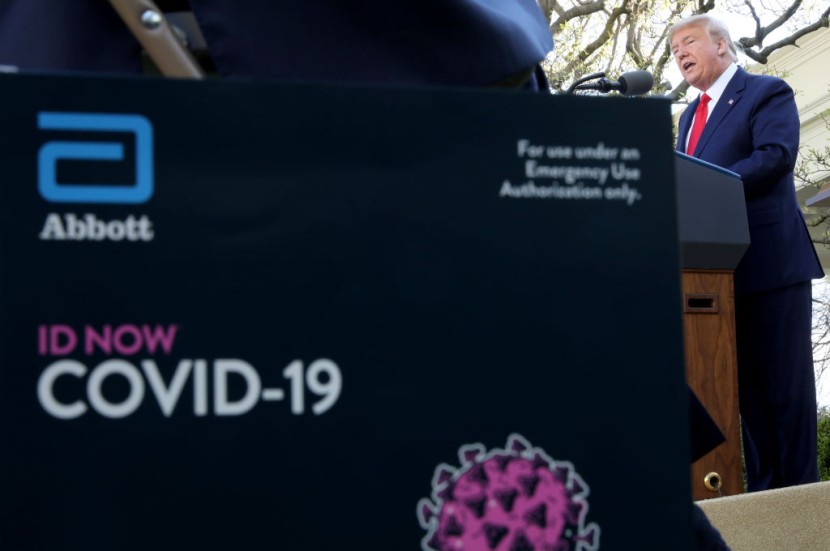

Stocks diminished on Friday after United States President Donald Trump made an announcement that he had contracted COVID-19. Testing positive for the virus brought the pandemic into the Oval Office, threatening to disrupt the world's biggest economy's leadership.

The S&P 500 decreased 0.6 percent in late morning trading. This was hours after President Trump wrote on a Twitter evening post that he and the first lady had contracted COVID-19.

Market Uncertainty

After President Trump and his wife contracted the coronavirus, global equity markets fell. This piled into market uncertainty merely 32 days before the November presidential election.

Trump's appalling declaration ignited a risk-off mood among investors already concerned about an evasive COVID-19 relief package targetted at boosting an American economic recovery that has been losing momentum as witnessed by slowing growth in jobs in September payrolls data, reported Reuters.

In New York, the Nasdaq stock market diminished by 1.5 percent, while the broader market S&P 500 stood its ground better by an estimated 0.5 percent. In Toronto, TSX was quite up in the afternoon following having been down by as 1.5 percent for the majority of the morning, reported CBC.

The United States' Main Indexes

America's main indexes -- the S&P 500, the Dow Jones, and the Nasdaq -- diminished from 1% to 2.2% when trading marked its start on Friday, largely in line with market presumption. After minutes, markets increased by a small margin.

Trump took to Twitter his test results causing stocks to fall mere hours after the White House made a declaration that senior aide Hope Hicks tested positive for the coronavirus following traveling with Trump numerous times this week.

According to TD Securities analysts in a research note, "There was a knee-jerk risk-off reaction given the level of uncertainty but ultimately the market reaction will depend on a few questions. How sick does Trump get or does he remain asymptomatic?"

They also asked who else in the government is affected. "Does Trump get a sympathy vote and implications for the election? Implications for Phase 4 fiscal stimulus?" reported CBS News.

The automatic reactions cooled down as markets evaluated what Trump's testing positive for COVID-19 meant for the election and economy. This is taking into account presidential nominee Joe Biden's leading in the polls. The S&P 500 .SPX sustained some of the abrupt losses witnessed in futures overnight and was down to 0.8%.

Some haven assets rose higher, as 10-year United States Treasury bonds relented, which decline when securities prices rise and initially fell before shifting quite higher. The American dollar and Japanese yen increased pitted the majority of other currencies.

Trump's COVID-19 diagnosis led to US stocks' decline followed a devastating day for European equities and in Asia prior to that when stocks sold off abruptly following Trump's declaration momentarily. London's FTSE 100 marked its end of the day with a 0.4 percent, following a decrease of 1.2 percent previously in the trading session.

Related Article : Trump Calls for US Election Pre-Debate Drug Test for Opponent Biden