Tens of millions of Americans will be receiving the second round of stimuli checks after the $900 billion President Donald Trump signed COVID-19 relief bill on December 27.

Weeks of unemployment payment extension decreased

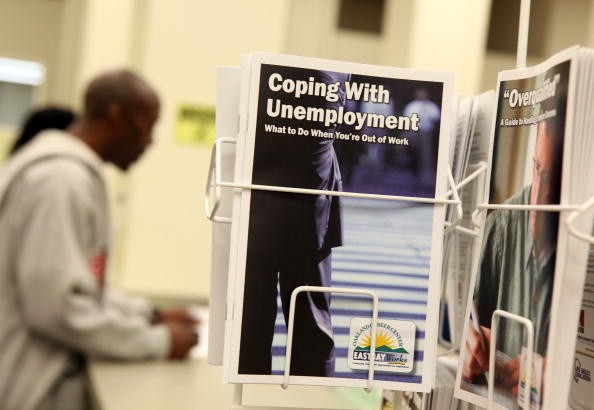

The stimulus bill includes a one-month extension of the eviction moratorium and a total of ten additional weeks extension of the $300 weekly unemployment payments for unemployed workers.

However, the extension for the unemployment bonus is supposed to be eleven weeks. The extension was diminished since Trump waited five days before signing the bill to release the stimulus checks. Trump urged to raise the $600 stimulus check to $2,000, but failed to be picked for a Senate vote on January 3, two days prior to the new Congress to be sworn in.

According to The Philadelphia Inquirer report, the U.S. Department of Labor will release guidance on how funds will be allocated, but states were told that beneficiaries would continue receiving payments. Nearly 12 million Americans receive the Pandemic Unemployment Assistance, as per TFC. They were also at risk of going a week or more without the payment due to the bill's delayed signing to make it a law.

Read also: What's Inside Your Stimulus Check and Everything You Need to Know

What more you need to know? Here are some important details that would answer the questions in your mind regarding the weekly unemployment bonus, according to CNET via MSN:

When will the $300 unemployment payments distribution start?

The stimulus bill has an initial date of December 26 to go into effect. But the delay is expected to be a week or more based on when the Department of Labor's act to guide the states about the fund's proceedings and how long it will take the states to start processing payments.

The stimulus checks are authorized to last up to March 14, but an overflow period will last until April 5 for people who exhausted their state's benefits before the expiration.

Will the bonus be retroactive?

The stimulus bill language does not determine if the unemployment bonus is retroactive, but that would not be the case, The Washington Post reported. The report added, observers do not expect to see a federally instituted lump sum payment to keep up for the previous weeks of not receiving unemployment benefits.

What is Mixed Earner Unemployment Compensation?

The new bill states that those who earned from traditional jobs and employment as a contractor would receive either the Pandemic Unemployment Assistance (PUA) or the unemployment insurance, but not a combination of both.

A person who made more money from self-employment or a contracting job could receive an extra $100 per week, with the Mixed Earner Unemployment Compensation. Let's say you earn $50,000 in 2019, which came from a contractor job ($30,000) and a part-time job at a company ($20,000). If you are laid off, the unemployment office in your state will calculate if you would receive benefits for the $3,000 through PUA or via unemployment insurance with your $20,000 earnings, but not a combination of the two.

The Mixed Earner Unemployment Compensation worth $100 will only be given to a person if the state participates. It might take some time before the states determine whether they will provide the extra $100 after the bill gets passed.

Read also: New Jersey Minimum Wage Increases to $12 per Hour, Aims to Reach $15 by 2024