The Internal Revenue Service or the IRS has issued or disbursed all of the legally permitted stimulus checks that the agency plans to send to eligible taxpayers, the agency mentioned Tuesday. Based on the IRS statement, taxpayers who have not received their checks yet or have received less compared to what they were qualified for can claim a credit on their 2020 tax returns.

IRS Says It Has Sent All Stimulus Checks

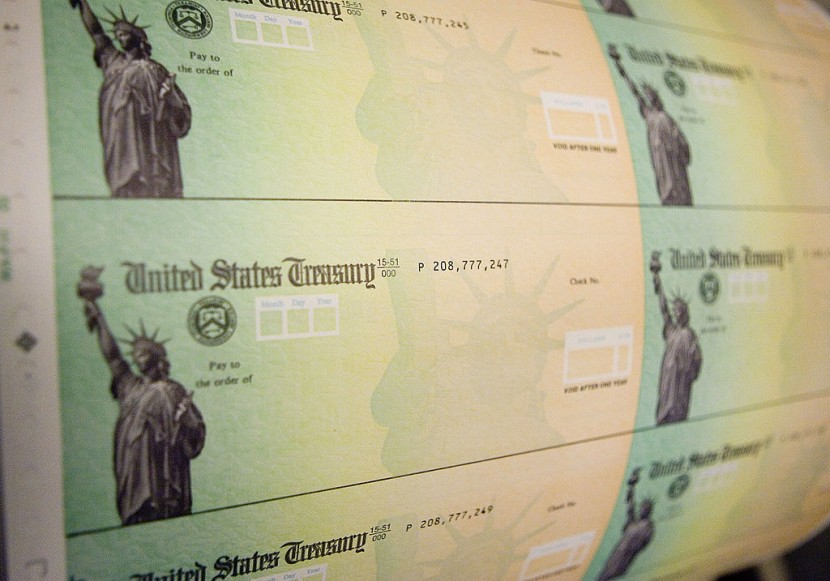

Last year, Congress has authorized two rounds of direct payments. The agency mentioned in a news release on Tuesday that it sent out not less than 160 million of the initial payments, which were established by legislation enacted in March.

In addition, the IRS also sent out more than 147 million of the second-round payments, which were provided for the legislation enacted in the month of December. The agency said on Tuesday that the payments, which include the latest $600 stimulus checks and the earlier $1,200 installments, have been issued.

Moreover, the agency also stated that it has now made the issuance of all the payments from the first two rounds that it legally can. The IRS based the issuance on the information that it has on file, The Hill reported via MSN.

As Congress directed the agency to make automatic payments of the second round of checks by January 15, experts said that some of the second-round payments may still be in the mail. Nearly 13 million payments that were misdirected last month had to be rerouted, CNBC reported.

Since the last update of the agency in its 'Get My Payment' web tool on January 29, the IRS has mentioned that it will no longer make any additional updates on the portal regarding the first two rounds of stimulus checks and payments.

The start of the tax-filing season began last week. Individuals who have not yet received the full amount of the payments for which they are eligible can claim the recovery rebate credit on their 2020 tax return.

Read also: Will You Need to Pay Taxes for Stimulus Checks? No, IRS Announces Stimulus Money is Tax-Free

Individuals who have not received their expected full payments include those who have lost a substantial portion of their income in 2020. It also includes people who welcomed new children in 2020 and those families who have mixed-citizenship status, as it created confusion initially.

According to The New York Times, the IRS has emphasized that taxpayers will need to know the amounts of any payments that they received previously before they claim the recovery rebate credit or can also be found on line 30 of the 2020 Form 1040 or 1040-SR. If individuals cannot remember the exact amount that they have received, the IRS advised them to check their accounts on the agency's online account system.

As the IRS continues to accept 2020 returns, which started on February 12. Individuals with an income of $72,000 or less in 2020 can use the Free File Program of the agency in filing their federal return for free.

Meanwhile, the house is yet to decide about the $1.9 trillion relief bill proposed by Biden, which would include a $1,400 stimulus checks.