Senate Democrats' proposed a $1.9 trillion COVID-19 stimulus bill that was unveiled on Thursday. It would exempt from taxes student loan forgiveness between 2021 and 2025. It would apply for forgiveness of student loans made, guaranteed, or ensured by the federal or state governments. This includes loans made by educational institutions and private lenders.

Stimulus Bill Exemption of Student Loan Forgiveness

It would not apply in cases wherein the loan discharge was made by a private lender, an educational institution, or in exchange for services performed for them. According to the Joint Tax Committee, the provision would cost $44 million in the course of 10 years. Under the current law, debt cancellation is generally included in taxable income. Student loan cancellation is tax-exempt merely in particular circumstances. The Senate is slated to approve the aid package this weekend, reported The World Post.

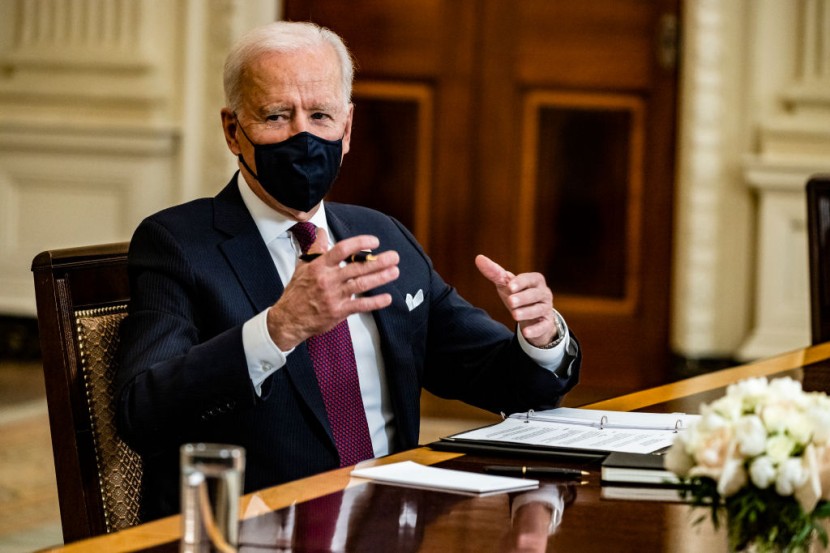

During the previous week, the House approved President Joe Biden's $1.9 trillion stimulus plan. The stimulus bill now advances to the Senate, where it is now being debated, reported Forbes. The Senate is slated to pass the novel coronavirus relief plan this weekend. However, lawmakers remain to negotiate the details of the bill. This is particular to those associated with unemployment benefits.

As a clarification, the relief package does not solve student debt. But the provision regarding exempting student loan forgiveness from taxes could help alleviate individuals from facing high tax bills if their debt is canceled in the future.

The small provision in this most recent stimulus bill could provide a large benefit to student loan borrowers. The legislation has many initiatives to provide financial aid to broad sectors of the American economy. This includes $1,400 in direct payments, housing and nutritional assistance, extended unemployment benefits, a new expanded child tax credit, economic aid to state and local governments, and funding for vaccine dissemination.

The relief package does not itself dismiss student debt. However, the provision on exempting student-loan forgiveness from taxes can help to alleviate individuals from facing large tax bills if their debt is forgiven soon.

As a background, student loan debt cancellation, which includes partial cancellation, could be regarded as taxable "income" to the borrower by state and federal taxing authorities. To put it in other words, the borrower or debtor might have to pay income taxes on the balance of the canceled debt.

According to Matthew Chingos, vice president for education data and policy at the Urban Institute, "The provision in the Senate bill is likely a necessary precursor to any kind of blanket forgiveness," reported The Hill. In other words, it may lead to other types of exemption.

Borrowers in such situations still often come out ahead in that they would pay remarkably less overall by getting their debt canceled. This is compared to how they otherwise would through its full repayment, even with the tax bill. However, due to canceled debt being a taxable event, borrowers could owe substantial taxes, which would be due simultaneously. If the borrower does not pay urgently by the tax deadline, penalties could be imposed.

Related Article : House Passes $1.9T Biden Relief Bill With $1,400 Stimulus Checks

© 2026 HNGN, All rights reserved. Do not reproduce without permission.