One of the biggest questions is whether a stimulus check for a deceased spouse or relative is still redeemable-these are concerns about whether the money can be kept or should be sent back.

Stimulus Check for Dead Spouse or Relative

Stimulus payments are clear cut for anyone receiving them; all the guidance is there. But what about those who are deceased who get payments? How do their next of kin deal with it?

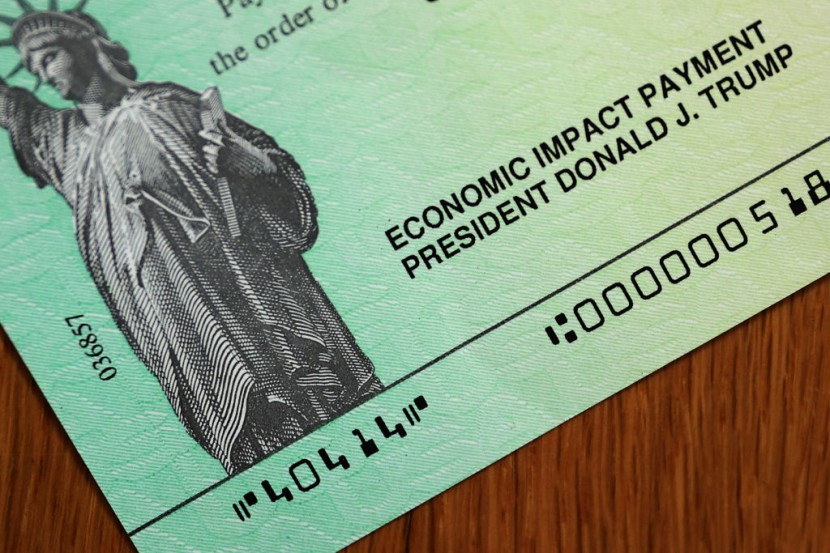

When the federal government gave out all the stimulus payment of $1200, it was assumed the recipient would be alive and kicking. Some of those deceased recipients had dependents who did not know if they can keep a dead spouse or relatives federal aid without committing a felony. Many would prefer to keep it, reported USA Today.

Financial hardships in the pandemic have made federal aid payments more crucial for affected families. Loss of a family member, spouse, and relative who availed of federal money returned is a big blow for many.

The ongoing pandemic put many filers in no man's land when it came to their taxes in the 2021 filing season. One specific problem is the unexpected death of family members, from COVID-19 specifically.

It should be noted these dependents might have lost their breadwinners to the virus, of the total reported 29.2 million. A death toll of 528,000 was registered, said the Johns Hopkins University data.

In the spring of last year, the IRS said that a total of $1.1 million stimulus check payments with an amount of nearly $1.4 billion for deceased recipients were sent out. IRS asked those families who received federal aid to return every single dime. This mistake was reported by the Government Accountability Office (GAO) that was problematic for families of deceased recipients.

Rushing to serve Americans with federal aid, the Treasury and the IRS failed to cross-check who was alive or deceased. During the first dole out, the pandemic financially hobbled Americans.

In December, the second round of stimulus for $600 was approved by the government. Only the recipients could get the money, but those dead people who got checks in the first round had to return the federal money.

Some recipients who died in 2020 or 2021 will be qualified for the Recovery Rebate Credit stimulus payments. If they did not get the Economic Impact Payments said Lisa Greene-Lewis, CPA and tax expert for TurboTax.

Will the deceased be a recipient? Some case says yes.

Should a prepared return for a deceased relative that died in 2020 or 2021 be allowed to receive federal aid? This would be via the Recovery Rebate Credit if they did not get any payment but a recipient.

Another way is to be a US citizen or U.S. resident alien, not a dependent of any taxpayer with a Social Security number valid for employment. Supposed the person died in 2020 but got no stimulus aid yet eligible based on their 2020 income in the tax filing. This will allow a claim through Recovery Rebate Credit via a tax return.

To get a stimulus check for the deceased, it can be redeemed through the Recovery Rebate Credit. Visit these sites and follow the instructions to process them. For spouses of the deceased, they can return the money meant for the deceased partner.

Related article: Third Stimulus Check for the Elderly: Changes, Rules for Retirees, SSI, Veterans