According to her most recent financial statement, Vice President Kamala Harris may be breaking her finance ethics promise by keeping money concealed in a tax-protected trust.

To align themselves with President Donald Trump and his potentially complex finances, Joe Biden and Kamala Harris vowed to maximize transparency and narrow loopholes throughout the race.

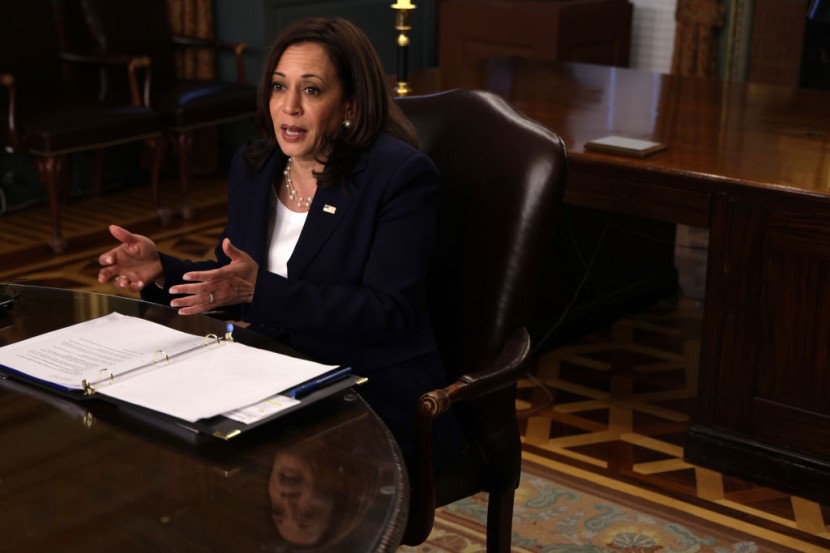

Kamala Harris appears to hide her assets in a tax-protected trust

However, Vice President Kamala Harris revealed Monday that since 2017, she had been a trustee of the KDH/DCE family trust. The entry states, "Trust assets are not reportable," potentially hiding any of her wealth from public view, Daily Mail reported.

Even so, during the campaign, Harris vowed to put an end to this practice. The Biden Plan to Guarantee Government Works for the People spelled out the pledge.

It focused on removing conflicts of interest and closing a loophole that encouraged candidates and elected officers to move properties to trusts owned by relatives or associates and reveal their existence.

Estate planning and tax minimization are common uses for family trusts. The Vice President's office did not respond to a call for comment.

According to a senior Republican, it demonstrated that Democrats had one set of rules for the people and another set of rules for themselves. "If the Democrats didn't believe in hypocrisy, they wouldn't believe it at all," said conservative strategist John Feehery.

Kamala Harris's net worth was disclosed in tax returns released on Monday. According to the report, in 2020, she and her first gentleman, Doug Emhoff, grossed about $1.9 million. Even then, it was a far cry from the $3.3 million they raised a year ago when Harris began seriously campaigning.

Fox News was the first to report on the possible violation of her ethics pledge, as well as a search of public documents for properties retained by the trust. According to the document, Harris and Emhoff used the trust to buy a condo in Washington, D.C., in 2017 that is now for sale for close to $2 million.

The couple placed their Brentwood, California home into the trust when they married in 2014. Emhoff had paid $2.7 million for it two years prior.

Biden, Harris release 2020 tax returns

Biden and Harris released their 2020 tax returns on Monday, reviving a White House tradition. According to IRS estimates, the president and first lady Jill Biden paid $607,336 in adjusted gross income, putting them in the top 1% of taxpayers.

Per CNBC, the Bidens paid income taxes totaling $157,414 at the cost of 25.9%. Harris and her second gentleman, attorney Doug Emhoff, posted a combined adjusted gross income of $1,695,225. They owe $621,893 in federal taxes or 36.7 percent of their income.

The President and the Vice President also shared financial disclosures for 2020. The Bidens had $90,289 in state and local taxes (SALT) but could not claim a deduction of over $10,000. The same $10,000 limit applied to Harris and Emhoff, who racked up a whopping $280,421 in state and local taxes.

Biden and Harris have shared their 2020 financial disclosures. The Bidens owed $90,289 in state and local taxes, but they were only allowed to deduct $10,000. Harris and Emhoff, who ran up a total of $280,421 in state and local taxes, were subject to the same $10,000 cap.

Former President Donald Trump's 2017 tax reform included a last-minute extension to the so-called $10,000 SALT deduction limit. Before the Tax Cut and Jobs Act, filers might subtract their entire SALT payment, which was a huge tax break for high-tax places.

Read Article: House Passes Bill to Counter Asian Hate Crimes, Only Needs Joe Biden's Signature To Become Law