In a little more than two months, a new wave of stimulus checks will begin arriving in the bank accounts of millions of households, marking one of the most significant transfers of wealth from the federal government to families of eligible children in response to the coronavirus pandemic to date.

According to BGR, starting on July 15, the IRS expects the first of approximately 39 million households to receive payments totaling up to $3,600 for each eligible child for a year. These upcoming payments would mark an increase in the federal tax credit, which was previously limited to $2,000 a year. These sums are per child, and what's fascinating about the payments is the potential beneficiary base. We're talking about families, so there's a large population of people who might benefit from this money.

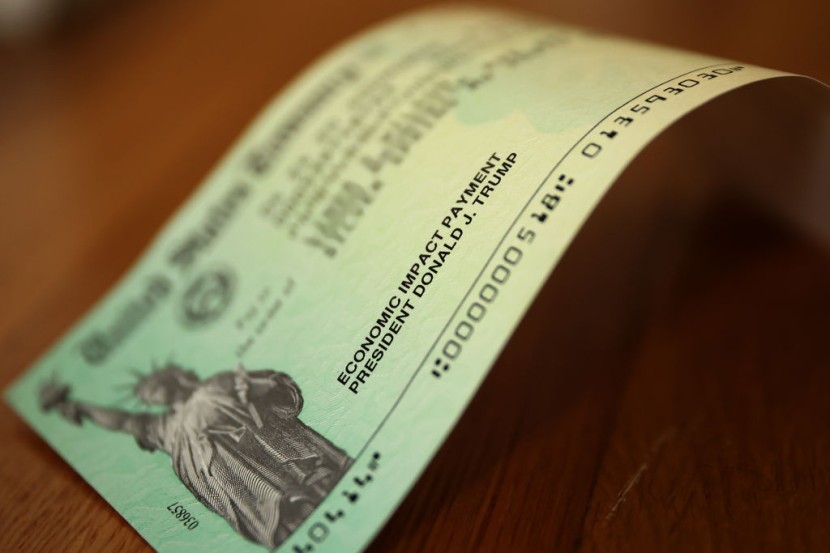

These increased federal child tax credit benefits are superior to the three prior rounds of stimulus payments for a variety of factors. One is that the payments for the child tax credit are more than twice the size of the previous largest stimulus check, which was $1,400. The Trump administration issued two $1,200 and $600 stimulus checks in 2020, with President Biden's administration issuing the third round of $1,400 stimulus checks earlier this year.

Read Also: IRS Sends $1,400 Stimulus Checks' Final Batch, Here's When to Request Payment Trace

How does the Child Tax Credit work?

With the Tax Cut and Jobs Act of 2017, the Child Tax Credit was last revised, as per AS.com. The credit was increased to $2,000 per child, but only $1,400 was refundable. Furthermore, a filer had to prove earned income of more than $2,500 to receive the refundable portion of the credit. Above that, the taxpayer could only claim a part of the credit's refundable portion before their income allowed them to claim the entire refundable amount.

Childhood poverty is predicted to be cut in half by 2021, now that the earnings limit has been eliminated and the credit is completely refundable. The measure, however, will only be in place for a limited time, with the amendments scheduled to expire at the end of the year.

President Joe Biden has stated that he would like to extend the adjustment until 2025, when the 2017 amendments would also expire, reducing the credit to $1,000. The hope is that the improved credit will be so successful that voters will choose to keep the improvements in place. As part of the American Families Plan, congressional Democrats intend to make the permanent credit beginning this year.

Who is eligible for the $3,6000 new stimulus check?

Previously, most taxpayers could save up to $2,000 per child on their federal income tax bill. Families will get a $3,000 tax break for each child aged six to seventeen under the new legislation, but only for the 2021 tax year.

For each child under the age of six, you will get $3,600, as per The Sun. Those with dependents between the ages of 18 and 24 who are enrolled full-time in college will also earn $500 each.

The child credit cash will be distributed to any household with children who applied for the most recent $1,400 stimulus check. Independent taxpayers with a modified adjusted gross income (AGI) of $75,000 or less, heads of household with an AGI of $112,500 or less, married couples filing a joint return with an AGI of $150,000 or less, and registered widows and widowers with an AGI of $150,000 or less are eligible for the maximum credit. If you receive more than this, the additional $2,000 credit, either $1,000 or $1,600 per child, is reduced by $50 for every $1,000 in adjusted AGI.

Read Article: Fourth Stimulus Check: Will It Ever Come as Payment Faces Uphill Battle? The Truth About the American Rescue Plan

@YouTube