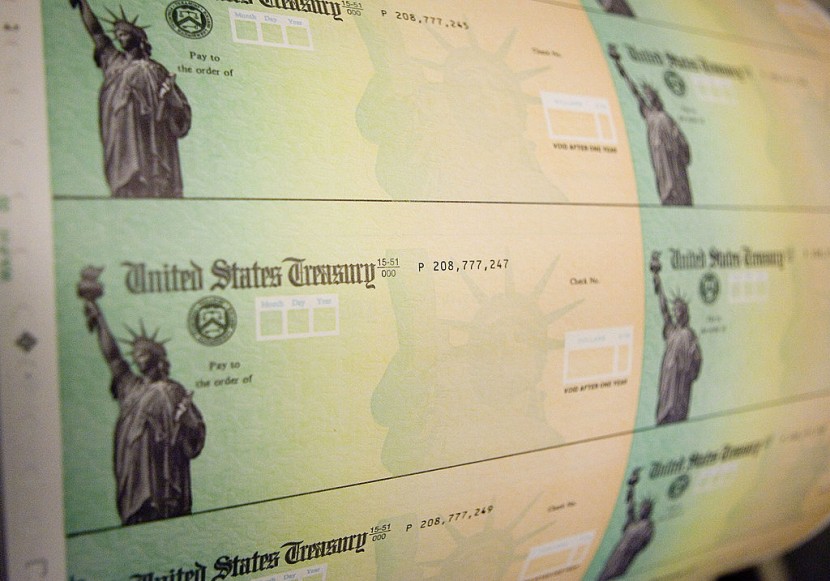

In a week, the new Child Tax Credit will go into effect. On July 15, the Internal Revenue Service (IRS) will pay up to $300 per month per child to millions of parents. The payments will continue until the end of 2021, and the overall amount might be higher than any prior stimulus payment.

If the proposed American Families Plan passes in its current form, the Child Tax Credit might be extended beyond this year. Some see the recently enlarged Child Tax Credit, which now pays between $3,000 and $3,600 per year to qualified families, as an extension of the Universal Basic Income (UBI) concept.

Child Tax Credit compares to Universal Basic Income idea

Progressive proponents of the payments have drawn parallels to a universal basic income. Republicans who oppose the Child Tax Credit, on the other hand, have made them. Sens. Marco Rubio (R-Texas) and Mike Lee (R-Utah) described the Biden administration's expansion of the Child Tax Credit as a UBI program in a press release.

Per The National Interest, the senators said, "This kind of universal basic income makes more Americans dependent on the government and severs the vital elements-work, marriage, community, and beyond-required to raise healthy families."

Rubio and Lee took issue with a clause in the March 2021 American Rescue Plan Act that made the Child Tax Credit refundable, meaning it would be paid out even if a household owes no taxes. The two senators claimed that this disincentivizes work, which is a common issue of UBI; but one that has been called into question in the past years.

Meanwhile, on Wednesday, July 7, President Joe Biden visited McHenry County College in Illinois to share his vision for America, Forbes reported. While the President is pushing the concept of "generational human infrastructure" through a variety of programs targeted at assisting Americans, there are several moving parts to his goal.

Read Also: Fourth Stimulus Check Status: How to Get Money While Waiting for Congress to Pass New Legislation

Biden urges to add new feature in Child Tax Credit

The implementation of the new Child Tax Credit, which is set to begin on July 15, 2021, is one of the main investments he intends to make. Biden wants to make it clear that this credit is designed to help Americans.

The President noted, "It's not a credit against your taxes, you'll get cash. Cash. You get the first half of $3,600 paid out between July and December, and you get the rest between January and Tax Day." Biden also wants to go a step further by extending the incentives for Americans who qualify until 2025.

He plans to do this through the American Families Plan, which Democrats are attempting to pass through Congress. An extended credit would have a big impact.

The $3,000 or $3,600 benefit for American families that receive it for five years may drastically alter their financial situation. Lower-income Americans will be able to give their children a more conducive environment. This may allow middle-income Americans to save for education or assist pay for childcare.

Earlier this year, a group of Democratic legislators urged for the increased credit to be extended permanently, but Biden has only agreed to a four-year extension. Biden also demanded that the school system be stretched from 12 to 14 years, as well as that childcare be made free, as per The Sun.

The initiatives are part of his "human" infrastructure plan, which he is attempting to get through Congress. Two years of free pre-K for three and four-year-olds, as well as two years of free community college, would be included in the 14 years.

The address, which gathered roughly 100 Trump supporters, came just days before millions of Americans receive their first "family stimulus" checks on July 15. Eligible Americans will get one check each month until the end of the year, valued up to $300.

The IRS has developed an interactive eligibility assistance tool on its website if you're unsure if you qualify for the credit. Non-filers can also check their eligibility on the federal agency's website.

The tool is intended to be used by low-income Americans who do not earn enough to be required to submit a tax return. If you make less than $12,200 as a single taxpayer or $24,400 as a married couple filing jointly, you don't have to submit a tax return.

Related Article: Fourth Stimulus Check Direct Payments Until 2025 Proposed: Joe Biden Pushes For Cash Assistance Instead of Tax Credit

@YouTube