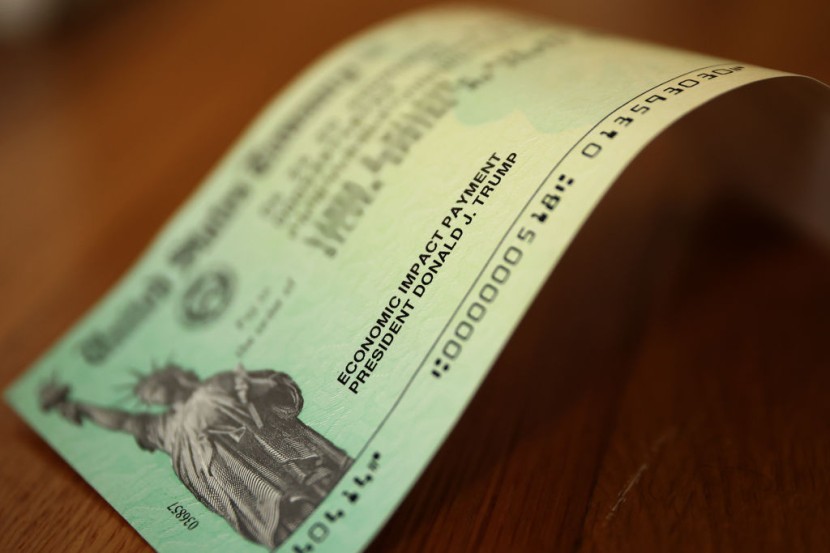

While the IRS has sent several billions of dollars in stimulus checks to Americans, a large number of people have yet to receive them. If you have yet to receive a stimulus payment or received less than what was promised, you are most likely qualified for the 2020 recovery rebate credit.

Even if this is not an option for you, the IRS recommends that you file a tax return for the prior year to claim this credit. If you don't own any money, you won't be penalized if you file after the deadline has passed.

Delayed payments in child tax credit

Meanwhile, on August 13, up to $300 per child in stimulus payments would be delivered to an estimated 39 million households, with payments expected to arrive in bank accounts days later. According to The Sun, Joe Biden's enhanced child tax credit scheme is responsible for the additional benefits.

Families are eligible for up to $3,600 per child under the age of six and $3,000 for dependents aged six to seventeen. As soon as the child was born in the United States, they are also eligible for the full $3,600.

Payments are paid in $300 or $250 installments, with a further five stimulus checks arriving before the end of the year. The balance can be claimed when tax returns are filed the following year.

The IRS said this week that certain taxpayers with Individual Taxpayer Identification Numbers (ITINs) are still waiting for their first although the first wave of payments was sent out on July 15.

Those who did not get the payment, on the other hand, will receive the whole amount over the year. Parents who do not get advance payments will be able to claim the entire child tax credit when they file their 2021 federal income taxes next year.

What about missing second, third stimulus checks?

You must know how much money you got in the first and second stimulus checks. This amount may be found by logging into your online account on the IRS's official website or by consulting Notice 1444 for the first payment and Notice 1444-B for the second payment.

The IRS, by the way, has already mailed them to the addresses it has on file. You may also use another method, which requires you to use the child tax credit non-filer sign-up tool, which allows you to provide the necessary information to receive monthly CTC stimulus check payments straight into your bank account.

This information will undoubtedly be used by the IRS to deliver any recovery refund credits for the previous year. When you submit a tax return for the previous year, the IRS has an easier time determining whether or not you are qualified for advance payments, as per Digital Market News.

Contact the IRS for your queries

For many people, keeping track of their stimulus checks has always been a challenging task. The IRS always suggests checking the progress of your payment using the site. However, utilizing the portal might be challenging. To obtain information from the portal, you must first fill out essential information and then go through an endless list of menu options.

Per Value Walk, there is now an easier method to contact the IRS; and all you have to do is pick up the phone and call the agency. You may reach the IRS by dialing 800-919-9835. This is the IRS Economic Impact Payment phone line, which will put you in touch with a live person.

When it comes to getting your job done, speaking with a representative is generally a good option. It also aids in the retrieval of answers to all of your inquiries, including those for which there are no responses on the site.

The IRS has been plagued with questions since the stimulus checks were distributed last year. At the same time, the agency is experiencing a staffing shortage. Now that things are starting to normalize, calling the IRS directly should answer your questions.

The above phone number will not connect you to a live person; instead, a virtual assistant will take your call. The virtual assistant will do all in its ability to respond to your inquiries. If you insist on speaking with a representative, the computer will soon connect you with one.

Calling the IRS when you have spare time is a good idea since connecting with a representative can take longer. Furthermore, before you phone, make sure you have your questions prepared as well as your essential personal information.

Related Article: When Will The Surprise Stimulus Check Worth $8,000 Arrive: Who Will Get Paid?

@YouTube