The Internal Revenue Service (IRS) deadline of August 30 is approaching, and further stimulus checks and unemployment benefits might hit your bank account in September.

The IRS is set to begin sending additional stimulus checks on August 13 and again on September 15. August 30 is the last day to sign up for the September 15 payment.

For the adjustment to take effect in September, anyone wishing to get their next mid-month child tax credit check must notify the IRS with any updated information by midnight on August 30. President Joe Biden's American Rescue Plan, which was signed into law in March, includes the increased funds.

The payment is the second in a series of six that will be paid to qualifying families. Many Americans, on the other hand, are wondering if they will receive a fourth stimulus check and, if so, how much it will be worth.

Some lawmakers have advocated for $2,000 monthly payments to be issued to all Americans, but a fourth stimulus check is unlikely. Even while coronavirus infections are on the rise and calls for more stimulus money persist, unemployment benefits will expire next month.

On September 6, the relief package, which has been in existence for around 18 months, will come to an end. When the payments, which are worth $300 a week, stop in a few weeks, around 7.5 million Americans are expected to lose out, as per The Sun.

Next stimulus check coming in September

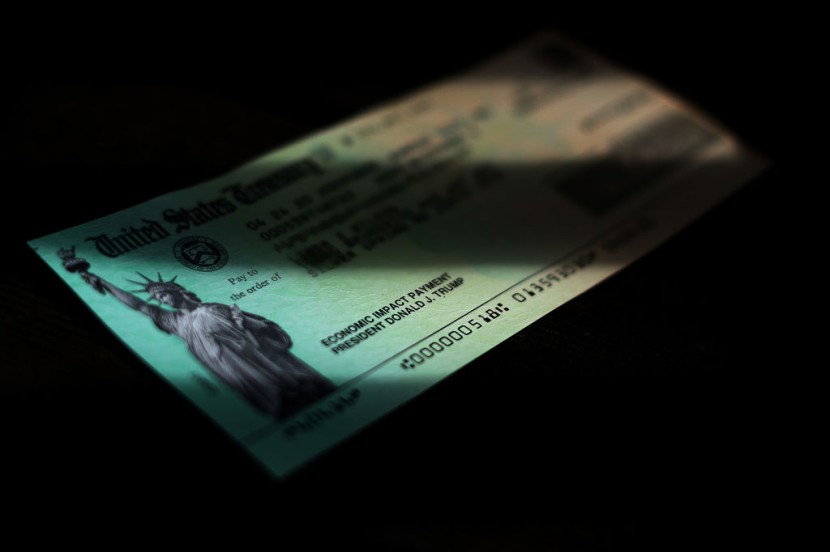

The IRS wants receivers to be aware of one unusual "issue." Some people who received their first child tax credit payment via a direct transfer in July received their August payment as a paper check, and it's unclear why. The paper checks, on the other hand, take a little longer to arrive. According to the IRS, less than 15% of direct deposit recipients in July were affected by the problem.

According to the IRS, the problem should be resolved by the time September payments are given out. This will occur on September 15. Individuals who have been affected do not need to take any further action to have their payments returned to direct deposits.

Families can check the Child Tax Credit Update Portal to see if they'll get a direct transfer or a paper check this month. There is one additional item to keep in mind. Because the third child tax credit stimulus payment is due in less than a month. Any changes to the information the IRS has on file for you must be made by August 30. If you want your next stimulus check to arrive on time, you must do so.

This might entail double-checking your banking information, for example, so that your payments, which will be sent by direct transfer, will arrive sooner. You will be given a stimulus check if you qualify. According to BGR, you are not required to take any action.

However, you must be mindful of the August 30 deadline in certain instances. For example, if you haven't yet filed your tax return, this will result in a spike in the cost of collecting these payments. The IRS determines your eligibility and payment amount based on your most recent tax return.

For people whose income is too low to file taxes normally, the Non-Filer Sign-Up facility is available until October 15. Go to the update portal link above if you need to make any changes, such as changing your bank account details. The IRS notes, "changes made before August 30 at 11:59 p.m. ET will take effect with the September payment."

Update your details through the IRS portal

Per CNET via MSN, you can also use the Child Tax Credit Update Portal to add any changes that have occurred since you last filed your taxes. If you had a new baby in 2021, or if you added a qualified dependent, or if your income changed lately, the IRS would not have that information on file yet. The IRS plans to expand the portal's functionality by the end of 2021.

You may use the site to update your banking and mailing details right now. You'll be able to add or remove qualified children later this summer, record a change in your marital status or income, and re-enroll in monthly payments if you are previously unenrolled.

If you filed your taxes by the May 17 deadline, you should have automatically received the July 15 advance monthly payments. Families that do not file income tax returns on a regular basis can register with the IRS and receive payments through an IRS nonfiler portal. The tool, however, has been criticized for being difficult to use, especially on a smartphone.

Related Article: Stimulus Check Update: Got The Wrong Amount From Child Tax Credit or Denied From Previous Payment? Here's What to Do!

@YouTube