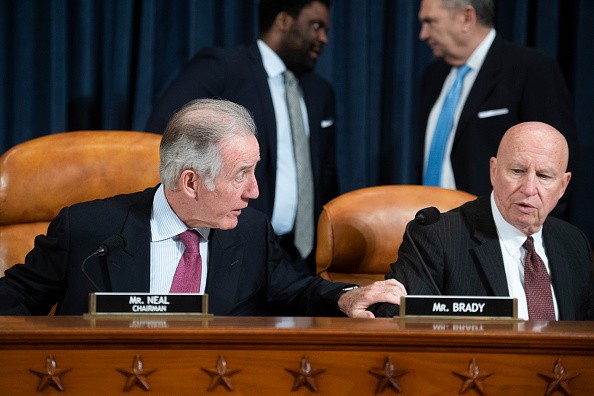

The House Ways and Means Committee releases section and part of the Democrats' $3.5 trillion social spending plan that includes the expansion of Child Tax Credit, infrastructure financing, clean energy incentives, and health care.

The House Ways and Means Committee Approved Several Portions of the Bill

In a recently published article in The Hill, the 645-page bill part was released after the committee passed several other sections of the measure earlier this week, including those on paid family leave and extending Medicare.The committee will discuss the new part on Tuesday.

The Ways and Means Committee have yet to produce legislative language on any tax hikes that would be used to offset the cost of additional expenditure. And, for a final law to reach President Biden's desk, it must be approved by both House and Senate Democrats, who disagree on certain issues.

The Ways and Means Committee's revised draft language would prolong until 2025 a one-year increase of the child tax credit that Democrats passed earlier this year - the same year that most of the individual tax changes in Republicans' 2017 tax-cut legislation are scheduled to expire. A part of the increase would be made permanent, allowing low-income families to receive the entire credit amount, according to a report published by Press From.

Changes of the Proposed Extension of Child Tax Credit

The House Ways and Means Committee's plan would prolong the American Rescue Plan's modifications to the Child Tax Credit until 2025. The $250 monthly advance payments for children aged six to seventeen and $300 for children aged six to six will be maintained for the following four years. However, the $3,000 and $3,600 total credit amounts would be adjusted to account for inflation in the future years.

With the removal of the $2,500 earnings ceiling in 2021, more families will be eligible for the Child Tax Credit. Children without a Social Security Number will now be eligible for advance payments under the plan published Friday, enabling parents who file their taxes using an ITIN, an Individual Taxpayer Identification Number used by resident and non-resident immigrants to file taxes, to claim the tax credit, according to a report published in Diario AS.

Furthermore, families will be asked to confirm their eligibility each year in order to continue receiving payments in the future years. The IRS will continue to maintain the online site it established for parents to update their information if their financial or family circumstances change. However, depending on information acquired from government programs or birth certificates, children may still be automatically registered for advance payments.

Will the Child Tax Credit Be Extended After 2025?

Democrats sought to make the Child Tax Credit adjustments permanent. However, proponents had to settle for a more limited extension due to party opposition to the $3.5 trillion reconciliation bill's high price tag, not to mention that such an extension would have eaten up nearly a third of the proposed amount Democrats have authorized for the spending package. The aim is that when the program's next expiry date approaches, the program's popularity will compel legislators to prolong the modifications once again.

If Congress does not extend the modifications until 2025, the Child Tax Credit will revert to the $1,000 credit level that taxpayers could claim before the Tax Cut and Jobs Act of 2017. (TCJA). Families who file taxes with an ITIN, on the other hand, will be eligible to receive the reduced Child Tax Credit after 2025, with the TCJA's SSN requirement for children removed if the budget plan passes.