Democrats proposed to raise the capital gains tax and qualified dividends to a total of 28.8% on Monday, marking one of many tax reforms that officials are discussing to target rich individuals to help fund a $3.5 trillion government budget plan.

The proposal would make the top federal tax rate on long-term capital gains 25%, which is an increase of 5% from the current 20%. The tax is added to an existing 3.8% surtax on net investment income, bringing the total tax percentage to 28.8%.

New Tax Reform on Wealthy Americans

The new tax reduction would affect stock and other asset sales that occur after Sept. 13, 2021, which is when House Democrats introduced the tax portions of their proposal. Taxpayers would be taxable by the new percentage starting in 2022. Residents will be deducted the new amount based on their income, which is at least $400,000 for single filers, $425,000 for heads of households, and $450,000 for married couples filing jointly.

The House Ways and Means Committee announced the new percentage and aligns with United States President Joe Biden's pledge to avoid taxing individuals making less than $400,000 any more. However, the new number is still lower than the current income thresholds where the top rate applies, CNBC reported.

Additionally, lawmakers are bringing back a tiered system for corporate taxes, which would increase the rate from 21% to 26.5% for firms that have more than $5 million annual revenue. The legislation also lowers the rate for companies that earn less than $400,000 down to 18%. Companies that fall between the two thresholds will maintain the current 21% tax rate.

Many of the tax reform legislation are set to reverse the 2017 tax cuts enforced under former United States President Donald Trump's administration. The tax cuts were believed to be unimpeachable by many GOP members. House Democrats are also expected to propose an increase to the top marginal tax rate that would give Americans who are earning at least $435,000 annually a 39.6% tax rate, up from 37%, USA Today reported.

Paying for the Government's Budget Plan

The tax reform legislation would raise taxes in the country by more than $2 trillion, which will be used to pay for the government's expansive social policy and climate change package. Despite the substantial scope of the proposal, it largely keeps lucratively wealthy individuals, such as Jeff Bezos and Elon Musk, and inheritances, off the table of affected areas.

House Democrats decided to be more conservative and became more mindful of concerns within their party than prioritizing their agenda. Lawmakers focused increasing tax on the traditional way of increasing revenue, which is residents' income rather than their wealth.

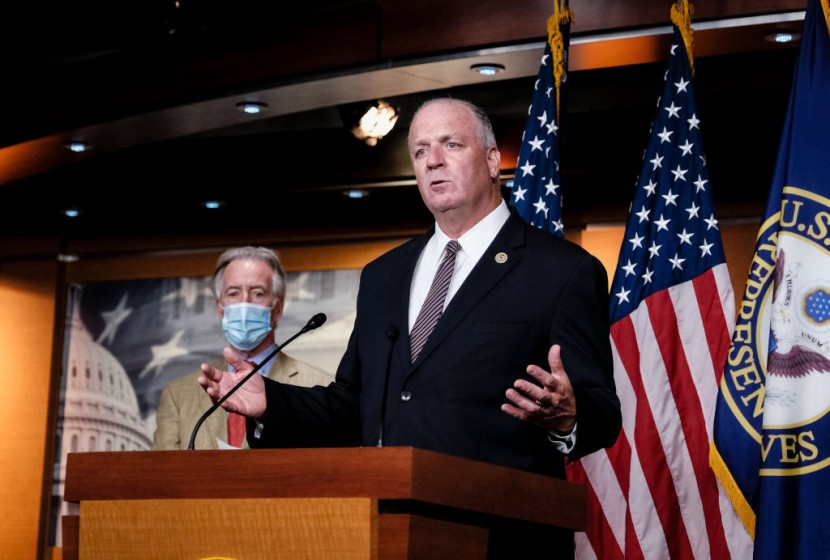

Ways and Means Committee Democrat Rep. Dan Kildee of Michigan, who is the author of the legislation, said it was "the boldest common denominator." The official said the legislation had a lengthy process to go through before being passed, needing 218 votes in the House, 50 votes in the Senate, and the signature of the president of the United States, the New York Times reported.

Related Article:

© 2025 HNGN, All rights reserved. Do not reproduce without permission.