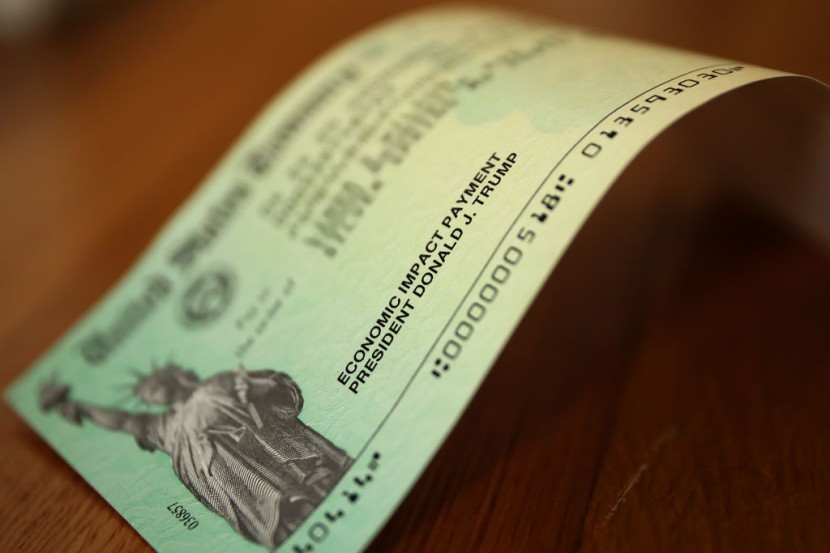

The approval of the Build Back Better Act in the House of Representatives brought monthly payments for certain Americans one step closer to being a reality in 2022.

The Build Back Better Act, signed by President Joe Biden, extends the increased Child Tax Credit, which is now paid in monthly stimulus payments, until the end of 2022. With a price tag of $2 trillion, it faces an uphill struggle in the Senate, but if enacted, eligible guardians would be able to continue receiving monthly checks for another year.

When Congress enacted the American Rescue Plan in March, payments for the Child Tax Credit were boosted to $3,600 for children under the age of six and $3,000 for children aged six to seventeen. It also changed the way Americans were given credit. Many Americans have been getting half of their projected credit in monthly installments of $300 for each kid under the age of six and $250 for all other eligible children, rather than a flat sum after filing their taxes.

These stimulus payments are supposed to expire in December; but if the Senate passes Build Back Better, they will be extended. The Build Back Better Act would modify the system to allow people to receive their entire credit in monthly payments rather than half in monthly payments and half after filing taxes, as per Newsweek via MSN.

How to apply for the Tax Child Credit refund?

Per MARCA, if you are among those who are entitled for this Child Tax Credit refund, you will get half of the amount in advance monthly installments if you filed your tax returns before 2022. You can claim the other half as soon as you file your 2021 income tax return.

Keep in mind that these monthly payments will be accessible only to taxpayers with yearly incomes of less than $150,000 (for married couples filing jointly), $112,500 for household heads, and $75,000 for single filers. Children under the age of 18 will get $3,000 per kid and an additional $600 for child under the age of six.

The American Rescue Plan, which President Joe Biden signed in March, makes the Child Tax Credit fully refundable for parents. Regardless of each parent's income or tax responsibility, low-income earners will get the entire value of their credit.

This effort will benefit low-income parents and assist reduce the number of children living in poverty. Parents could only obtain a part of this tax relief of up to $1,400 as a refund before the measure was enacted by the House of Representatives, but higher earnings would get the entire amount of it.

Read Also : These States Will Give You More Stimulus Checks Until December 2021; How to Check Payment Availability

Build Back Better proposal's future remains unclear

Low-income taxpayers might only obtain a portion of the tax reduction, up to $1,400, as a refund before March 2021, while higher-income earners would get the whole value. They were also ineligible for the credit if they earned less than $2,500 a year, since it used to be that persons had to earn more than a certain amount to file a tax return and collect the credit.

However, as a result of the March revisions, no taxes will be due when someone files their 2021 tax return. Because the Child Tax Credit is entirely refundable, it is probable that beneficiaries will be entitled for a refund, which will be used to offset taxes owed at the conclusion of the fiscal year.

The future of the credit is undetermined because both chambers of government have yet to adopt the Build Back Better plan. If Congress does not agree to approve the package or adopt a separate bill extending the credit, it will expire and revert to its previous form, making 24 million youngsters ineligible the next year, as per AS via MSN.

Related Article: Last Stimulus Check in 2021: Will You Get The Final Payment for This Year? Here's How to Make Sure!

@YouTube

© 2025 HNGN, All rights reserved. Do not reproduce without permission.