The IRS says it has finished mailing out stimulus checks; but depending on your 2021 taxes, you may be eligible for extra money.

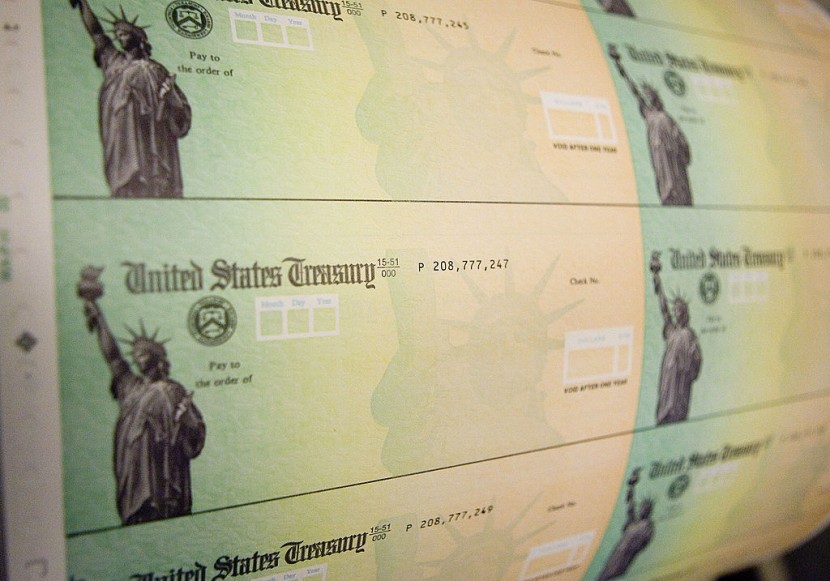

The IRS distributed more than 175 million Economic Impact Payments as part of the American Rescue Plan to assist people in coping with the pandemic's impacts.

The law allowed the IRS until December 31, 2021, to disperse the funds, which amounted to COVID-19's third stimulus check. The IRS said last week that the procedure had been completed. Some checks "may still be in the mail," but "the IRS is no longer issuing payments as required by law," according to an announcement.

You may still get your lost stimulus check

Don't panic if you haven't received your third stimulus check or believe you are entitled to extra money. The third-round Economic Impact Payment was an early payment of the 2021 Recovery Rebate Credit, allowing you to recuperate lost funds by filing a tax return and claiming the credit.

This is especially significant since the IRS calculates stimulus payments using tax data from your 2020 return or earlier, and additional money may be available if your circumstances have changed since then. The amount of your Recovery Rebate Credit on your 2021 taxes is determined by your income and the number of qualified dependents.

If your income has decreased since your 2020 tax return and/or you added a new dependent to your family in 2021, you may be eligible for more stimulus money when you submit your taxes this year. According to Money.com, the Recovery Rebate Credit may be used in the following situations:

- If you have a new kid or dependent in 2021 and list your child as a dependent on your 2021 tax return, you may be entitled for a credit of up to $1,400, according to the IRS. Similarly, if you've added another dependent - such as a grandchild, parent, or other qualifying relative - you may be eligible for a credit of up to $1,400 per person.

- You may be entitled for a $1,400 credit if you earned more than $80,000 (or $160,000 for joint filers) in 2020 but less than that amount in 2021. Similarly, if you earned between $75,000 and $80,000 in 2020 (or $150,000 and $160,000 jointly) but less in 2021, you may be eligible for a partial credit comparable to "plus-up payments" in the form of a tax credit.

According to the IRS, the credit will either lower your tax payment or be applied to your refund, and it will not be delivered as a separate check.

Read Also : Unclaimed 2021 Stimulus Check: This Document Is a Must-Have To Claim Your Remaining Payments

IRS urges parents to claim their remaining Child Tax Credit

Additionally, the IRS is urging new parents to claim the Child Tax Credit on their 2021 tax returns in order to get a credit of up to $3,600 per kid (birth, adoption, or foster care).

Due to the lengthy holiday weekend, tax season began on January 24 and will finish on April 18 in most states. In most circumstances, it's best to file as soon as possible in order to receive a prompt refund.

If you believe you are still due stimulus funds, make sure you have all of the necessary information regarding any prior stimulus payments before submitting.

The IRS will give you the information you require in the mail, in the form of Letter 6475, as per Nasdaq. If you didn't receive the letter or threw it away, you may check the specifics of your stimulus payment on your IRS online account under the "Tax Records" section.

Related Article: You Might be Qualified for Another $1,400 Stimulus Check; Watch Out for IRS Letter To See If You Are Eligible for More Payments!

@YouTube