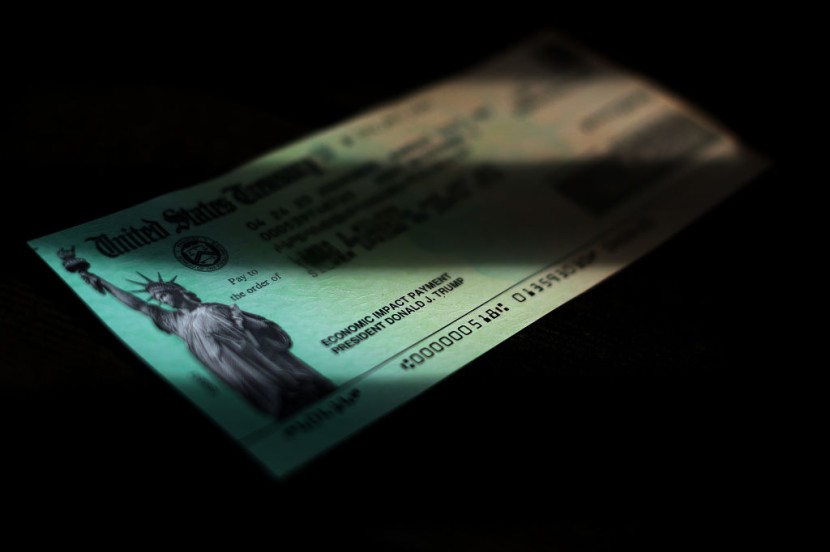

Dr. Joshua Robinson, a well-known professor at the University of Alabama, claims that the notion of stimulus checks is the primary cause of inflation in the United States.

This is due to the fact that the stimulus check was created to provide money directly to the hands of ordinary people in order for them to cover their bills during the COVID-19 pandemic.

Previous Stimulus Checks Impact the Inflation Rate

In 2022, the inflation rate climbed by 7.5 percent over the previous year, with a total of $20 billion circulating in the US economy. The goal of stimulus checks, according to Robinson, was to address the economy's severe downturn by delivering money to the people. However, the money was spent on services and commodities, causing the product's price to rise.

In a report by Digital Market News, he also claimed that enabling individuals to spend their money puts the entire country at danger of inflation. The Fed must, however, ease the restrictions gradually, as recklessness might lead to a recession. If the stimulus check plan is abandoned, the country would enter a recession that will harm both the people and the economy.

The COVID-19 pandemic led to a spike in the unemployment rate, which is now approaching 17 percent despite the official figure of 14 percent. This level of unemployment essentially equates to a state of depression. According to a UAB professor, the United States' situation will return to normal in a year. In general, inflation is defined as a progressive increase in the prices of goods and services, which results in a decrease in the value of money.

Inflation is affecting every aspect of the economy. At the end of January, the annual rate of inflation had hit 7.5 percent, the highest level since 1982. Gas costs, for example, are rapidly climbing, with a gallon costing $4.25 on Wednesday, up from approximately $2.86 in March. Filling a 20-gallon tank now costs $85, up from $57.20 at the same time last year, according to CNN.

Read Also: Record-Breaking Gas Prices Won't Ease Anytime Soon; How Can President Joe Biden Help Americans?

Could There Be Another Round of Stimulus Checks?

According to a recent report by Moody's Analytics, inflation costs the typical household $276 each month or $1,100 every quarter. Given the volatility in oil prices as a result of Russia's invasion of Ukraine, it wouldn't be shocking if those expenses jumped to above $300 per month. Many Americans, particularly those with low and moderate incomes, are unable to bear such steep price rises.

Democrats required the very contentious Build Back Better legislation to pass for the expanded credits to remain for another year, which has not happened partly owing to opposition from Sen. Joe Manchin (D-WV). Senators have long argued that extending the credits would discourage people from working and that any new federal expenditure would worsen the existing inflationary pressures.

Meanwhile, Sen. Mitt Romney (R-Utah) has suggested a monthly cash assistance program with job restrictions, most likely in an effort to get more bipartisan support. The Family Security Act seeks to provide $350 per child to qualified families with children under the age of five and $700 per child to households with children aged five to seventeen, as per The National Interest.

Related Article: IRS Freezes Filing Tool for Child Tax Credit as Agency Fears Turmoil During Tax Season

@YouTube

© 2025 HNGN, All rights reserved. Do not reproduce without permission.