A New York Federal Reserve analysis released on Tuesday revealed that an increase in delinquencies last year among a smaller pool of student loans not covered by a forbearance program signals likely problems ahead for almost 37 million loans when the program expires.

Borrowers under the forbearance program have been exempt from making loan payments since March 2020, but the suspension of payments is due to terminate at the end of April. According to the New York Fed, $195 billion in payments have been waived over the period.

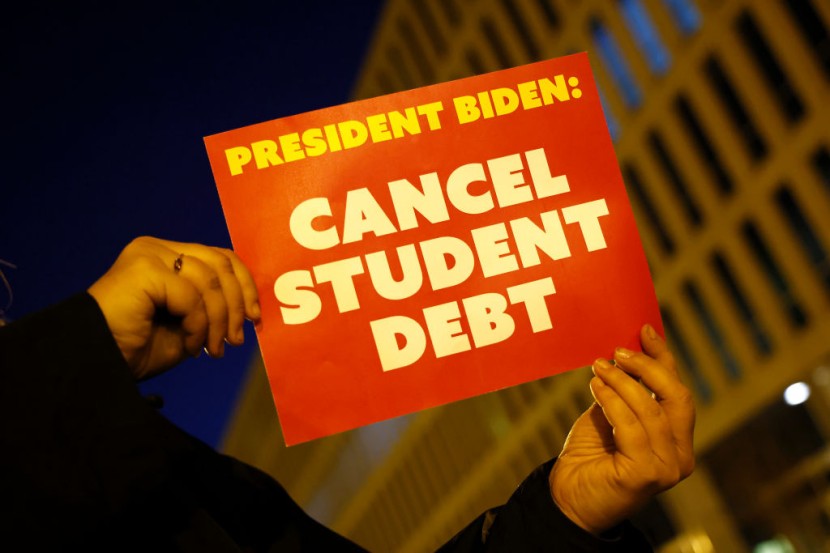

Student Loan Delinquencies Expected To Spike

Borrowers in a smaller pool of around 10 million loans given privately or via the Federal Family Education Loan (FFEL) system who were not protected by the forbearance program struggled with debt payments over the last two years. Delinquency rates for FFEL borrowers have been rising since March of last year, and by the end of December, they had returned to pre-pandemic levels, according to Reuters via MSN.

Delinquency rates among student loan borrowers in the two-year forbearance program, on the other hand, plummeted to a low of 3.6 percent at the end of last year. This is bad news for people who were enrolled in the program and had greater loan levels, poorer credit ratings, and were making slower repayment progress than FFEL borrowers before the pandemic.

Another set of Democratic lawmakers also expressed their views on student loan repayments, stating that borrowers should not be required to repay their debt in less than two months, Business Insider reported.

On Monday, 43 Democratic legislators, led by Pennsylvania Rep. Conor Lamb, wrote to President Biden, demanding that the moratorium on student loan payments be extended "at least until the end of this year."

They cited a 2020 Education Department report that noted the "heavy burden" of transitioning millions of federal borrowers back into repayment. They wrote that, while the economy has made progress in pandemic recovery, households across the country continue to face financial hardship.

Read Also: Stimulus Check New York: $1000 Available for New Yorkers [Eligibility, Requirements, How to Apply]

Democrats Think Student Loan Repayment Is Too Soon

Payments on student loans with waived interest have been on hold for more than two years, and Biden just extended it for the third time. However, as the deadline approaches, Democrats in both the House and Senate have raised concerns about returning federal borrowers to repayment too soon despite Republicans denouncing additional borrowers' relief as being too costly to taxpayers and the economy.

Patty Murray, the former chair of the Senate education committee, issued a statement last week urging Biden to extend the payment moratorium until 2023 so that he can "permanently fix" the loan system by restoring defaulted borrowers to good standing and fixing flawed loan forgiveness programs, among other things.

The difficulties FFEL borrowers had making payments during the pandemic "suggest that Direct borrowers will face rising delinquencies once forbearance ends and payments resume," according to the researchers.

As of February 2020, students with direct federal student loans had larger debt levels and poorer credit ratings than students with private loans or FFEL loans, as per The Hill.

The research comes just over a month before the moratorium on federal student loan payments and interest accrual is slated to end. President Biden prolonged the ban, which began during the Trump administration and has been extended many times until May 1.

Related Article: Increase in Food Prices Make Low-Income Americans Turn for SNAP Benefits; Here Are the States Offering Aid in 2022

@YouTube