According to a recent report produced by the US Treasury Department, about 645,000 Americans who were declared qualified for the third wave of stimulus checks approved under the American Rescue Plan had not received their $1,400 direct payments as of mid-September.

As of September 16, 2021, the Internal Revenue Service (IRS) has distributed payments to around 167 million persons, accounting for approximately 99.5 percent of the total. The amount of money missing is believed to be $1.6 billion.

The audit also found that over 1.2 million payments totaling over $2 billion were given to persons who were most likely ineligible. It's possible that some of the payments were given to ineligible dependents, non-residents, or families who altered their tax-filing status.

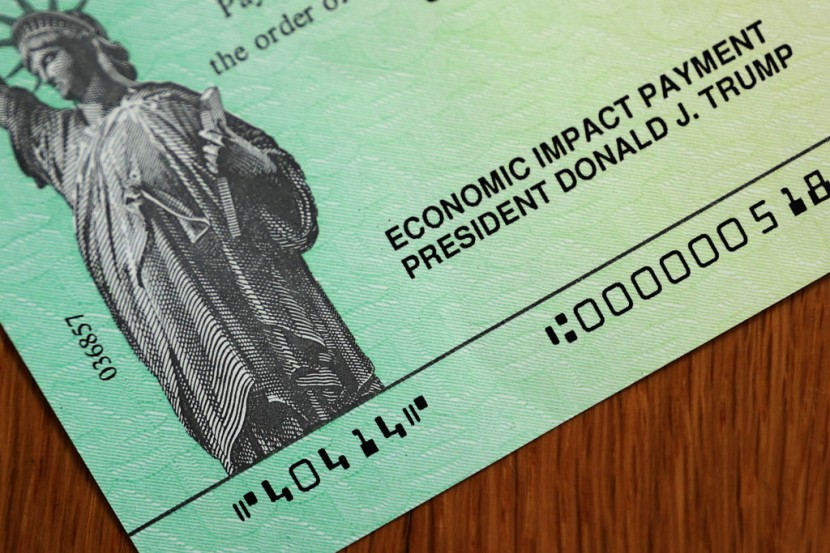

Congress approved three stimulus payouts for most Americans throughout the two-year pandemic: a $1,200 check in April 2020, a $600 check in December, and the $1,400 payments approved last spring.

Despite these timely checks, many individuals have called for a new wave of direct payments to assist mitigate the consequences of current strong inflationary pressures, which have hit a four-decade high, as per National Interest.

How To Track Missing Stimulus Check?

You may wait a bit longer before doing something because the third stimulus checks are still being issued. But if you haven't received your first or second check, it's time to take action.

The Get My Payment feature makes it simple to monitor the status of your third stimulus check. If the IRS site shows your payment was made but you haven't received it within the time range stated in the chart above, you'll need to request a payment trace.

You must enter your Social Security number or Individual Taxpayer Identification Number, date of birth, street address, and ZIP or postal code to use the service. The site will display your payment status, whether or not your funds have been scheduled, as well as the payment method (direct deposit or mail) and date. You may receive a different message or encounter an issue.

Call the IRS at 800-919-9835 or send or fax a completed Form 3911, Taxpayer Statement Regarding Refund, to obtain a payment trace (PDF). Note that if you contact the number, you will be required to listen to the recorded content before speaking with an agent.

The IRS gives the following guidelines for filling out Form 3911 for your third stimulus check:

1. On the top of the form, write "EIP3" (EIP stands for Economic Impact Payment.)

2. Fill out the form completely, answering any refund questions that pertain to your payment.

3. When completing item 7 under Section 1:

- Check the box for "Individual" as the Type of return.

- Enter "2021" as the Tax Period.

- For the Date Filed field, leave it blank.

- Please sign the form. Both spouses must sign the paper if you're married and filing jointly.

If you've already requested a trace via phone, you shouldn't send Form 3911. You should not seek a payment trace to see if you were entitled to a check or to validate the amount you should have gotten, CNET reported.

Stimulus Check History Online

The quickest method to find out which Economic Impact Payments, often known as stimulus checks, you've received is to visit the IRS website.

Your payment history is accessible through your Online Account, which you may access using your IRS username or ID.me account. You may also locate your history of advance Child Tax Credit payments and data from your most recently filed tax return, in addition to information regarding the stimulus checks.

You can create a new account on the IRS website if you do not currently have access to your Online Account.

Your stimulus check history is also displayed on IRS notices. While the IRS website has up-to-date information on your stimulus check payments and other tax programs, you should have also received a breakdown of the payments in the form of an IRS notification. Over the last two years, the tax agency has mailed notices to recipients of any of the three rounds of payments. The notifications were mailed to each recipient's address on file with the IRS.

- Notice 1444: The first Economic Impact Payment for the 2020 tax year is described in detail.

- Notice 1444-B: The second Economic Impact Payment for the 2020 tax year is described in detail.

- Notice 1444-C: The third Economic Impact Payment for the tax year 2021 is described in detail.

Letter 6475, which describes the amount received during the third round of stimulus check payments as well as any plus-up payments received after submitting 2021 tax forms, is also being sent out by the IRS. These letters will be issued throughout March 2022, so if you have not yet got yours, keep a watch out during the next two weeks, according to AS USA via MSN.

Related Article : Fourth Stimulus Check Would Be Possible This Year With High Gas Prices; Here's How It Will Happen, How Much You Could Receive

@YouTube