The distribution of fourth stimulus check is still unlikely to happen, but states are doing their best to provide payments amid the economic struggle.

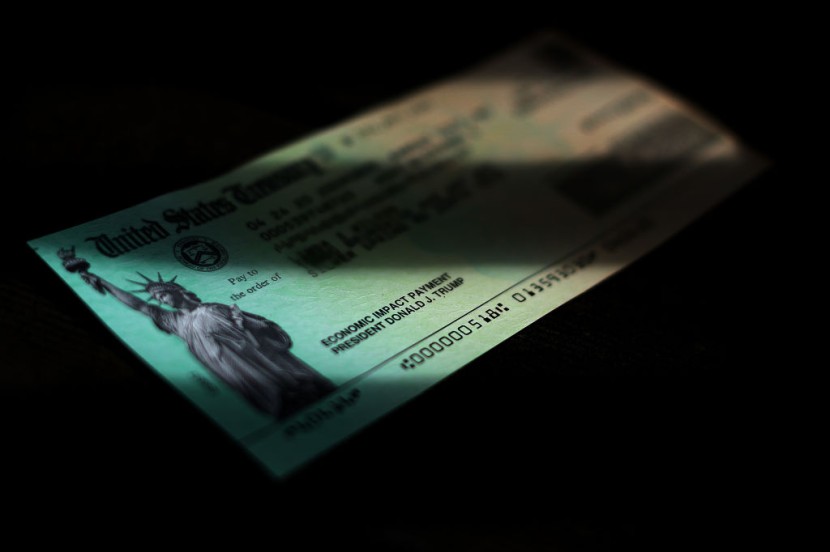

At the onset of the COVID-19 pandemic in March 2020, Congress enacted the bipartisan CARES Act, which would offer a one-time stimulus check of up to $1,200 to the majority of Americans. Then, in December 2020, Congress passed bipartisan legislation that provided most Americans with extra checks worth up to $600. Democrats pushed through the American Rescue Plan without Republican backing after President Joe Biden assumed office. A direct payment of $1,400 was included in that bill.

Pennsylvania Citizens May Receive $2,000 Stimulus Check

Millions of individuals signed online petitions seeking more direct payments in response to the stimulus cheques. While the federal government is unlikely to issue new checks anytime soon, a number of state authorities have began their own initiatives as households feel the effects of inflation.

Pennsylvania Governor Tom Wolf, a Democrat, said this week that many state citizens will get $2,000-worth stimulus checks. Governor Wolf's proposed PA Opportunity Program would employ $500 million in ARPA (American Rescue Plan Act) money to provide direct payments of up to $2,000 to Pennsylvania households with an income of $80,000 or less.

According to a Thursday news release on the governor's website, the initiative intends to assist families still recovering economically from the COVID-19 pandemic or to assist them in covering pandemic-related expenditures and managing the present, ever-increasing cost of living.

While the notion may appeal to many Pennsylvania families and people, it is uncertain if Wolf's plan will be implemented. Republicans who dominate the legislature in the eastern states are skeptical of the idea, claiming that there are better ways to spend ARPA monies, as per Newsweek via MSN.

Rep. Madden said, "We are still experiencing global inflation, and the rising cost of living is impeding the recovery of working-class families, who form the backbone of our communities." Furthermore, if the state government is unable to spend the whole $2.2 billion in federal cash by the end of 2024, the money will be transferred to the federal government.

Wolf's plan also includes $225 million for small companies impacted by the lockout, $325 million for the state's healthcare system, and $204 million in property tax relief.

Pennsylvania has set aside $450 million for conservation and preservation projects, as well as community regeneration. It's unclear how the cash will be used or whether they'll be used entirely, Unica News reported.

Read Also : Calls for Investigation Against Hunter Biden Mount; Who Is His Business Partner Related to the US President?

Stimulus Checks by States

The issue is that the federal government provided billions of dollars to the states during the pandemic, and there is a pool of money that has not been used to some extent. According to Marca, some of the assistance techniques that will be adopted in some states are listed below:

California: A proposed $400 gas tax rebate for up to two automobiles is being investigated.

Georgia: A $250 tax credit for solo filers, $375 for heads of households, and $500 for married couples filing jointly might be adopted.

Hawaii: All Hawaii taxpayers may be eligible for a tax reduction of $300 if they earn less than $100 and $100 if they earn more than $100.

Idaho: The larger of $75 or 12% of 2020 Idaho state taxes may be eligible for a tax rebate through direct deposit or printed stimulus check.

Indiana: A $125 one-time tax rebate might be implemented.

Kansas: The state purchase tax is being contested for reduction or removal.

Kentucky: There is talk of a one-time stimulus rebate of up to $500 per state resident and $1,000 per household.

Maine: Direct payments in the form of $850 stimulus checks might begin to be given.

New Jersey: A $250 property tax rebate for renters and an average of $700 for homeowners is being considered.

New Mexico: Effective January 1, 2023, a one-time tax break of $250 for single taxpayers and $500 for married couples filing jointly is proposed, as well as a refundable child tax credit of up to $175 per child.

New York: A property tax credit of $425 in New York and $970 outside the city might be applied in 2021, 2022, and 2023.

Pennsylvania: The potential of a 30% reduction in the state gas tax is being considered.

Virginia: The state food tax may be reduced or eliminated altogether, and the $0.262 per gallon state gas tax may be suspended for one year.

Related Article : COVID-19 Pandemic Changes Dress Code For US Offices

@YouTube