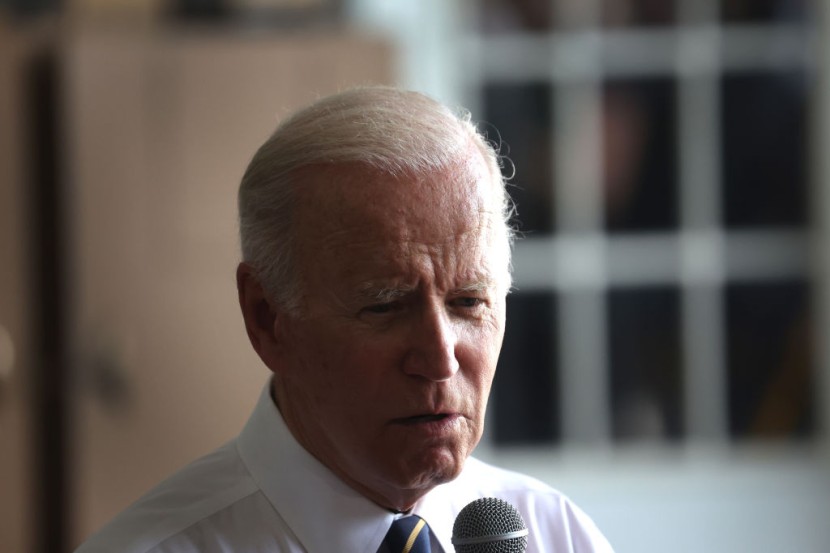

United States President Joe Biden has announced the cancellation of an Alaska oil and gas lease sale, raising concerns about the impacts it could cause on the country's gas prices.

On Thursday, gasoline prices in the United States hit a new record, the same day that the Biden administration announced the cancellation of three oil-and-gas lease sales. Republican lawmakers have continuously pointed to surging fuel costs as a rationale to sell more leases to drill on federal lands.

Biden Cancels Oil Lease Sales

Some of the members of the GOP have criticized Biden's decision because they argued that it only hurt America's energy independence. In a Twitter post, Alaska Gov. Mike Dunleavy said that the Democrat's decision "proved their lack of commitment to oil and gas development in the U.S."

A confluence of several trends has resulted in gas prices rising and the factors include an economic recovery that pushed up demand for energy. Furthermore, Russia's unprovoked war on Ukraine also dealt a blow to oil and gas prices, as per CBS News.

The combination of factors made the reaction of several lawmakers, consumers, and businesses unsurprising. They now want to see the United States' energy sector ramp up its production speed.

The national average gas price for regular unleaded was at $4.42 per gallon, which was more than $1 higher than this time last year. Since Monday, the price went up by nine cents and comes in spite of decreased demand, which would typically, pull prices down at the pump,

Read Also: Biden Holds Summit With Southeast Asian Leaders, Attempts To Address China's Growing Media Influence

According to Yahoo Finance, the Alaskan lease would have given companies the opportunity to drill for oil in Cook Inlet, Alaska, which is an area that spans one million acres. The Department of Interior said in a statement that there was a "lack of industry interest in leasing in the area."

The department must follow a five-year plan in order to auction off-shore leases and the current plan was set to expire at the end of May. Authorities said that there had been no interest in leasing the land.

Effect on Gas Prices

Since the area was not currently being leased, Biden's decision does not lead to a reduction in the amount of crude oil that is available. The cancellation only reduces the potential to mine for more oil in the region.

Frank Macchairola of the American Petroleum Institute said that with the kind of price environment that the country was experiencing, there are negative impacts to shutting off oil and gas development. He said that the situation will have an effect on both political and practical environments.

A spokesperson for the Department of Interior said that authorities will not move forward with lease sales 259 and 261 in the Gulf of Mexico region. They argued that this was a result of delays due to factors that include conflicting court rulings that impacted work on the proposed lease sales.

They added that there were 10.9 million acres of offshore federal waters that were already under lease to the industry. It was noted that the industry was not producing on more than three-quarters, which equates to roughly 8.26 million acres, Fox Business reported.

Related Article:

US Gas Prices Today: Why Is Oil Price Declining After Almost Reaching $5?