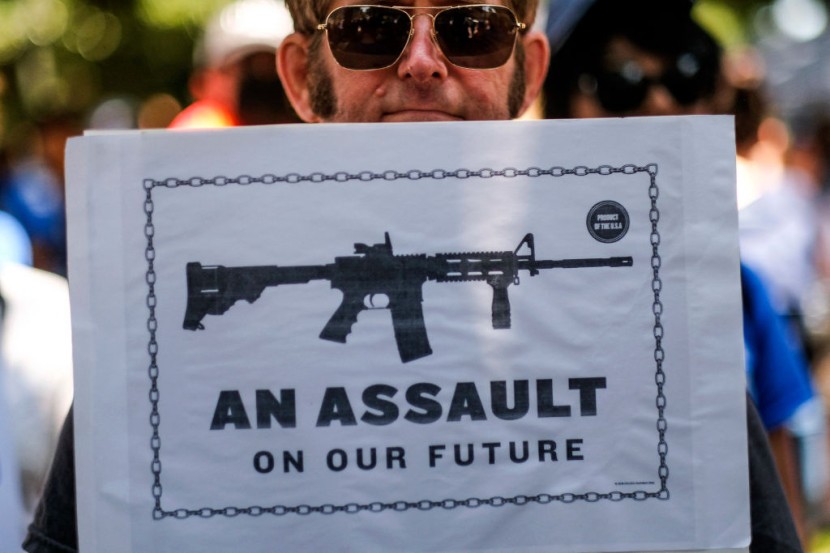

On Tuesday, Virginia Democrat Representative Don Beyer filed legislation that would charge a 1,000% excise tax on assault-style guns and high-capacity ammunition magazines.

The Assault Weapons Excise Act intends to raise the price of the AR-15-model rifle used by the gunman in a mass killing in Uvalde, Texas, to $18,700. Daniel Defense, the gun's manufacturer, is currently selling the DDM4V7 version for $1,870 online, as per a Newsweek report.

Following the May 24 massacre at Robb Elementary School in Uvalde, Beyer declared his intention to draft the measure on June 5.

Authorities identified Salvador Ramos, 18, as the gunman in the tragedy that killed 19 children and two teachers. Ramos, who was shot to death by the police, reportedly purchased 2 two semi-automatic rifles before the incident-the DDM4V7 he used in the mass shooting and a Smith & Wesson M&P 15 he did not bring.

Senators Move to Fix US Gun Control Measures

A group of 20 senators declared on Sunday that they had reached an agreement on the primary priorities of a plan to overhaul US firearms regulations. Beyond the reforms already in the works, the 1,000% tax on semi-automatic Assault rifles would provide the Senate "an option for further action to address the epidemic of gun violence," Beyer said in a statement.

Even though the majority of Americans support tighter gun restrictions, Republican politicians have resisted bans on semi-automatic weapons such as AR-15s, which have been used in many mass killings. Such Semi-Automatic Weapons cost between $500 and $2,000, making them inexpensive to many users.

CBS News reports under the proposal, states would be incentivized to pass "red flag" laws, increase mental health resources, provide funding for school safety resources, clarify the definition of a federally licensed firearms dealer, and crack down on criminals who illegally purchase and traffic guns.

Beyer's bill could be filed through the reconciliation process since it imposes a tax, making it a revenue measure. That means it would only need the support of 50 senators rather than the 60 votes needed to overcome potential opposition and pass most bills.

He noted that the bill might "cut through the gridlock and get it done."

The measure exempts federal, state, and municipal entities, therefore, US military and law enforcement agencies would be exempt.

Further Evaluation Needed

However, according to Rosanna Smart, an economist at the Rand Corporation who has studied the impact of gun excise taxes, Beyer's proposal is far higher than existing municipal and federal weapons taxes.

She added that the Democrat representative's bill aims at a specific class of guns and is difficult to compare to other more modest taxes, per The Washington Post. Smart noted that to understand better the impact of a firearms excise tax by evaluating its effect on consumer demand, though "a 1,000 percent tax is going to tax some people out of the market."

"The question is if they're going to be able to find a substitutable [gun] that gets around that tax rate - or if they are so determined to buy the gun to commit a mass act of violence that price is not a deterrent," she said.

Whether Beyer's proposal will get traction in Congress is another matter entirely. Smart pointed out that the proposal combines two most polarizing ideas: tax increases and gun restrictions.

Related Article: Japan: Online Insults Can Now Lead to 1 Year in Prison, $2200 Fine After Death of Netflix Star