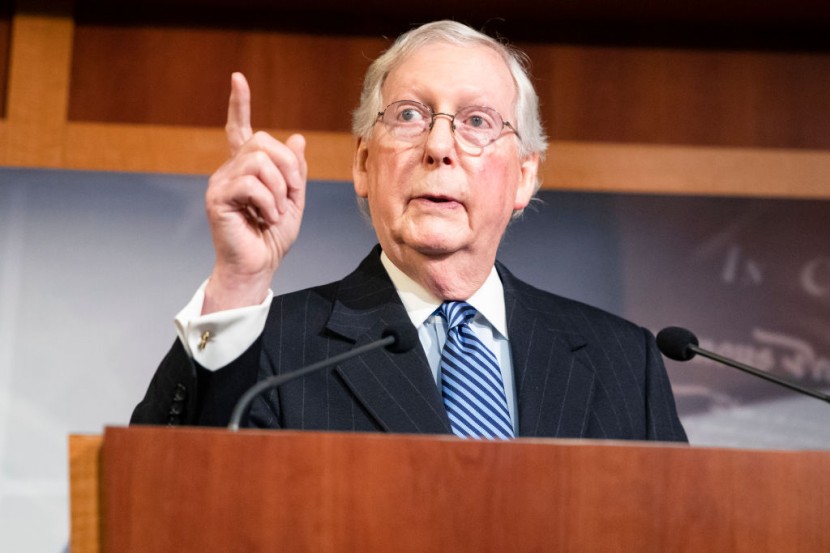

Senate Republican Leader Mitch McConnell (R-Ky.) criticized Senate Democrats for reaching a tax-reform agreement on Wednesday, saying that it will hurt people and eliminate thousands of American jobs.

He made the statement in response to a deal announced by Senate Majority Leader Charles Schumer (D-NY) and Sen. Joe Manchin (D-WVa.) that would raise $451 billion in tax revenue by instituting a 15% corporate minimum tax, beefing up IRS tax compliance enforcement, and closing the carried interest loophole for asset managers.

McConnell Assails Manchin's Surprise Economic Deal

Sen. Lindsey Graham (R-SC), the Budget Committee's leading member, aimed Manchin and said that the compromise made no sense. Senate Democrats may rename Build Back Broke as many times as they want, but it will be no less disastrous to American families and small businesses, he added, referring to the GOP term for Biden's spending proposal.

Raising taxes on job creators, suffocating energy providers with additional restrictions, and limiting inventors seeking breakthrough remedies would only make the recession worse, not better. The Republican senators released their views just hours after Federal Reserve Chairman Jerome Powell stated that the US economy is not in a recession.

The Inflation Reduction Act of 2022, proposed by Schumer and Manchin, would generate $739 billion in income. Aside from the tax proposals, it would generate $288 billion by allowing Medicare to negotiate cheaper prescription medication prices.

It would spend $369 billion on energy security and climate change projects, as well as $64 billion to prolong health insurance subsidies under the Affordable Care Act for three years until 2025, according to The Hill. Meanwhile, other Democrats were taken aback by Schumer and Manchin's surprise statement.

The reconciliation proposal, according to House Speaker Nancy Pelosi, is good news for House Democrats. When the last version of Build Back Better was being discussed in December 2021, Manchin indicated on Fox News. Sunday that he was a firm no on it.

Read Also : Sen. Chuck Schumer Expresses Support for Joe Biden If He'll Run in 2024 Presidential Election

Effects of Democrats' Reconciliation Bill

Democrats may be surprised by the last-minute tax compromise unveiled by Sen. Joe Manchin and Majority Leader Chuck Schumer on Wednesday, but it is a long cry from the wide slate of tax increases they had wanted to pass. Ambitious suggestions to tax the ultra-unrealized rich's capital gains, or to levy additional surtaxes on them, have vanished.

The Treasury Department's main objective is also out: tax rises on large firms are required to put the United States into line with a worldwide tax treaty. Even seemingly uncontroversial initiatives, such as a plan to start taxing stock buybacks, which had elicited groans on Wall Street, were dropped.

According to a summary provided by Manchin's office, the plan includes only two tax increases out of more than 40 seriously considered by Democrats - one imposing a new type of minimum tax on large corporations and another to close the so-called carried interest loophole, which Democrats have been trying to close for years.

Along with that comes a proposal to shore up IRS enforcement, which budget watchers say will save the government money. The idea would impose a new 15% minimum tax on large firms. The specifics are yet unknown, but it is intended at corporations who report large profits to Wall Street but appear to pay little or nothing to the IRS, Politico via MSN reported.

Related Article : Anthony Fauci Confidently Dares Republicans To Investigate Him, Days After Pledging To Resign Before End of Joe Biden's First Term

@YouTube