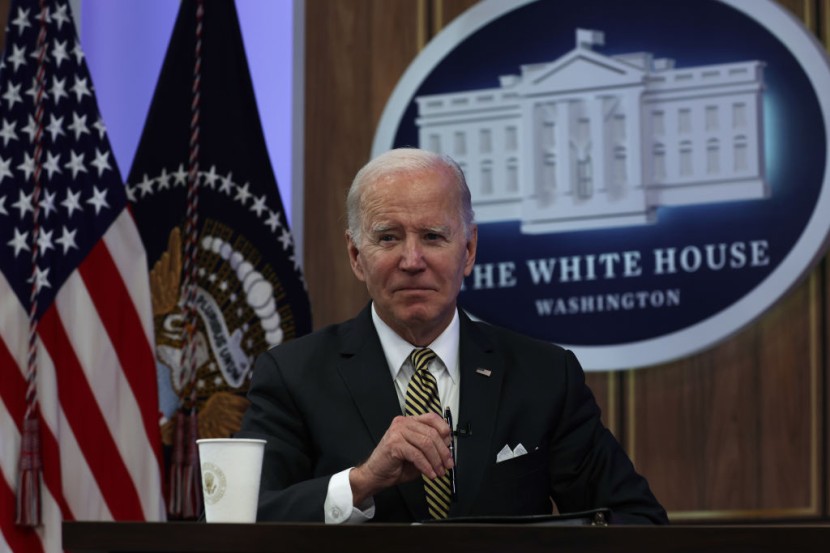

United States President Joe Biden's student loan forgiveness program could have a problem after a Wisconsin group asked the Supreme Court on Wednesday to block the debt relief as it is scheduled to take effect this weekend.

The request was made by the Brown County Taxpayers Association in Wisconsin and was directed to Justice Amy Coney Barrett. The latter is responsible for handling emergency application requests from the 7th Circuit U.S. Court of Appeals.

Student Loan Forgiveness Program

Earlier this month, a Wisconsin federal judge dismissed the taxpayers association's lawsuit that challenged Biden's student loan forgiveness program. They ruled that the group did not have legal standing to block the plan.

The group then decided to file an appeal of that ruling to the 7th Circuit appeals court. The request to Barrett asks that the debt relief program that would cancel up to $20,000 in student debt for millions of borrowers be suspended pending the outcome of the pending appeal.

The U.S. Department of Education opened its application for student loan forgiveness on Friday in a beta test. There were roughly 8 million people that submitted their requests for relief over that weekend, as per CNBC.

On Monday, the application officially launched and the Biden administration could begin processing the borrowers' requests for student loan forgiveness as soon as this Sunday. However, the legal challenges for the president's debt relief program continue to come his way.

Currently, there are six Republican-led states; namely Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina, that are trying to block Biden's debt relief program. They argued that the Democratic president does not have the power to issue nationwide debt relief without Congress.

According to CNN, the lawyers for the taxpayers' group said that the implementation of the student loan forgiveness program would deal a "staggering blow" to the U.S. Treasury and Americans as a whole.

Legal Challenges

They wrote in the new filing with the Supreme Court that we are now witnessing a gargantuan increase in the national debt due to a complete disregard for limitations on the constitutional spending authority.

On the other hand, the Biden administration argues that Congress gave the secretary of education the power to discharge debt in a 2003 law known as the HEROES Act. The independent Congressional Budget Office estimated that the president's debt relief program could cost up to $400 billion.

Biden's debt relief program, which was first announced back in August, seeks to provide financial assistance to millions of borrowers before federal student loan payments resume in January next year.

Under the Democrat's program, individual borrowers who earned less than $125,000 in either 2020 or 2021 and married couples or heads of households who made more than $250,000 annually in those years can see up to $10,000 of their federal student loan debt is forgiven.

The Biden administration previously closed the forgiveness program to borrowers with loans issued by private banks but guaranteed by the federal government. The decision was seen as an attempt to prevent lawsuits by state entities that invest in such loans, such as public entities in Arkansas, Missouri, and Nebraska, Reuters reported.

Related Article: Unclaimed Stimulus Checks: 9 Million Americans Can Receive Up to $3,600 This Year If You Receive This IRS Letter

© 2025 HNGN, All rights reserved. Do not reproduce without permission.