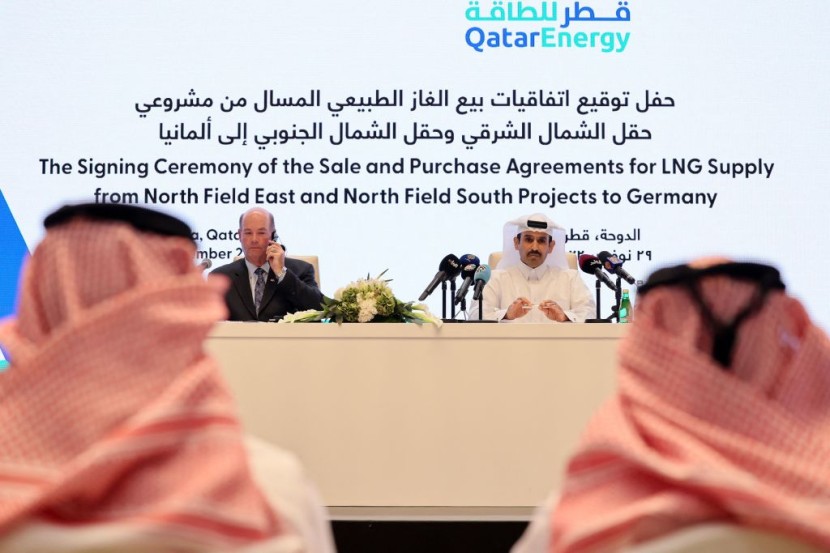

Qatar's Energy Minister Saad Sherida Al-Kaabi verifies a German gas deal to provide a long-term supply replacing gas lost via Russian sanctions.

Qatar-Germany Long-Term Gas Deal

Qatar signed a contract to provide Germany with liquefied natural gas (LNG) for about 15 years; worth two tons per year after an agreement last Tuesday, reported Almayadeen.

Berlin has been on the decline after it supported the US punitive actions against Moscow, leaving it having difficulty in acquiring gas caused by the Ukraine conflict.

Since the start of the war last February, competition for LNG supply has become intense, with Europe requiring large amounts to help replenish Russian pipeline gas, which composed up almost 40% of the country's imports.

By the middle of 2024, Germany, the biggest economy in Europe and a nation whose businesses are primarily fueled by natural gas, intends to completely replace its dependence on Russian energy.

The Qatari energy minister and CEO of QatarEnergy showed the deal that aims to help improve Berlin's lost energy security after blindly following wayward US sanctions.

Qatar's Energy Minister Lauds the Gas Deal

As said by Qatar's energy minister Al-Kaabi, QatarEnergy's partner, US firm ConocoPhillips, the German gas deal will provide the gas from Qatar's North Field East and South projects starting in 2026 to the Brunsbüttel LNG terminal getting established in northern Germany, citing the Local.

Asian countries like China, Japan, and South Korea are the primary customers for Qatar's gas, which has now been increasingly sought by European countries ever since the beginning of the Ukraine conflict and Russian sanctions

German Economy Minister Robert Habeck reacts on the 15-year deal, saying it is great.

However, Andreas Schroeder, the head of energy analytics, believed that its start date of 2026 was too late, as Germany required LNG in 2023 and 2024.

Unless German players assure adequate quantities at a reasonable price for 2023, they will be forced to regress to spot LNG marketplaces and risk exposing themselves to worldwide price fluctuations, mentioned Arab News.

After QatarEnergy revealed a 27-year contract to transport four million tons of coal per year to China, calling it the lengthiest agreement ever witnessed in the industry, the new agreement with Germany was attained a week afterward.

As shown in the deal, the Gulf country will provide the China Petroleum and Chemical Corporation (Sinopec) with 4 million metric tons of LNG (liquefied natural gas) yearly out of its newly formed North Field East (NFE) LNG plant.

Furthermore, the CEO of Sinopec also mentioned that he requested to acquire a share in the Qatar LNG project, in which Western energy companies had the largest chunk until now.

Russian LNG has increased at 42% before the price cap, per See News.

Shipments of Russian liquefied natural gas to the Union have risen by 42% between January and October 2022, according to Financial Times.

The proportion equates to approximately 17.8 billion cubic meters (bcm) of natural gas, with Belgium, France, Spain, and the Netherlands currently ranked as the top foreign buyers.

Last year, the EU sourced 155 bcm of natural gas and LNG from Russia, which is also viewed as the second-largest energy provider in the region.

Qatar’s energy minister hailed the German gas deal as the longest in the EU as Russian sanctions are self-imposed limit impacting the country.

Related article: Berlin Acquiesces To Join the Bloc in Joint Gas Purchases After Initial Reluctance to Support the Measure