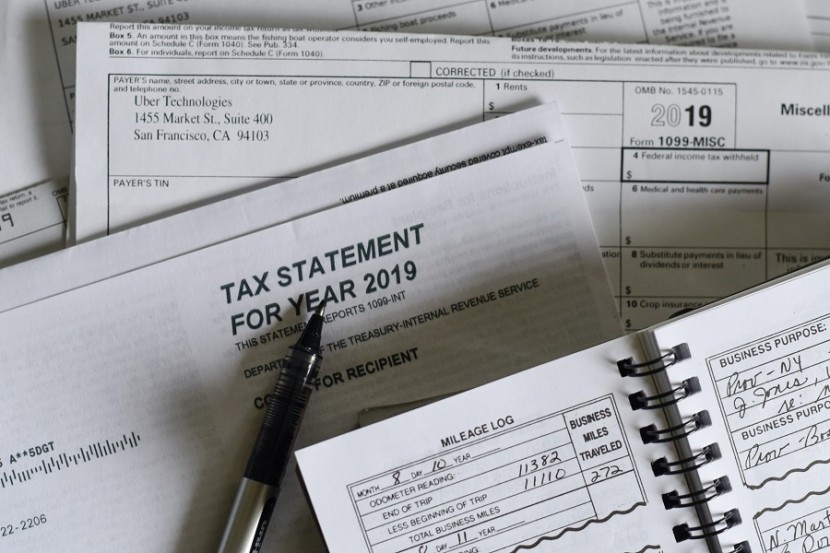

The IRS won't begin taking tax returns until January's end. You will likely not have everything you require, such as your W-2 and other pertinent paperwork, before the end of the month.

But if you want your federal tax return back as quickly as possible, you should follow this fundamental advice.

How to Receive Tax Refund Earlier?

File as soon as possible; file online, maybe using the IRS-supported IRS Free File or a commercial service like TurboTax or H&R Block.

And while filing online, request that your return be transferred through direct deposit to your bank or designated online account. Filing a return free of errors is also essential.

The tax-return advance is a short-term loan that provides you with your refund (or a portion of it) on the day you submit your taxes. The loans are collateralized by your anticipated refund and are typically repaid by (deducted from) your ultimate IRS refund.

If waiting up to 21 days is impossible this year, or if you're concerned about the IRS missing its deadline (think 2021, when millions of taxpayers saw their refunds delayed), then consider the refund-advance loans offered by H&R Block and Jackson Hewitt, two of the largest commercial tax-prep services. Per CBS News, both loans are offered at 0% APR, or annual percentage rate, with no fees.

Tax Changes

In a few weeks, you will be able to file your federal tax return. Even if you dislike tax season, now is a great opportunity to organize yourself so that the filing process is as streamlined as possible.

Reviewing this year's significant tax changes that will likely affect the size of your tax refund is a smart starting point, according to Marca.

Standard Deduction is Increased

In conjunction with the rate of inflation, the standard deduction normally increases year by a little amount.

For the tax year 2022, the standard deduction has been increased by $800, from $12,950 for single filers to $25,900 for married couples filing jointly. Additionally, income tax rates are raised in 2022.

In addition, the income tax brackets were adjusted for 2022 to account for inflation. Your tax bracket is determined by your adjusted gross income, which is the amount you earn before taxes are deducted but after itemized deductions and tax credits are applied.

Child Tax Credit is Back to Normal

The CTC has been decreased to its pre-pandemic amount of $2,000 per child or dependant. The credit is now only partially refundable for certain parents with lower incomes, and advance payments are no longer accessible.

Furthermore, the Child Care and Dependent Tax Credit will be available to fewer taxpayers. This tax advantage has also been reinstated for 2022 at its former amount.

Now, parents of a single child can deduct a maximum of $1,050 in qualified costs, or 35% of a maximum of $3,000. Multiple-child parents can claim a maximum of $2,100 for up to 35% of up to $6,000 in qualified costs.

It is Harder to Qualify For EITC

The maximum EITC claim for individuals without children or dependents in 2022 is $560, a decrease from the previous year's maximum of $1,502. To qualify, you must be between the ages of 25 and 65, a return to the traditional age limitations.

However, as a result of inflation, both the maximum credits for adults with children and the income criteria for the EITC have grown dramatically.

You May Still Owe Taxes Despite Student Loan Being Forgiven

You may have qualified for student debt forgiveness via the Public Service Loan Forgiveness program or another analogous effort, despite the fact that federal student loan relief is now on hold for the majority of borrowers.

Tax Brackets

New tax brackets and basic deductions are now in effect, which could increase wages and reduce income tax for many Americans, who start the new year still hurting from sky-high costs.

The Internal Revenue Service also increased contribution limits for tax-deferred retirement plans in 2023 and increased the mileage rate by 3 cents to adjust for inflation. Higher 401(k) limits can help individuals save more for retirement, which in many circumstances will reduce their income tax liability, as per Axios.

The new tax adjustments related to tax returns were filed in 2024, but the IRS also updated the tax withholding tables for 2023, which determine the amount of federal tax withheld from employee paychecks.

In the current era of high inflation, previously ignored cost-of-living adjustments, such as those on taxes, Social Security benefits, and salaries, are vital.

By revising the tax rates, as it does every year, the IRS aims to prevent "bracket creep," which occurs when inflation drives individuals into a higher income tax band without a corresponding rise in actual income.

Related Article : Student Loan Forgiveness 2023: Should You expect Great News or Start Paying Your Debt Next Year?

@YouTube