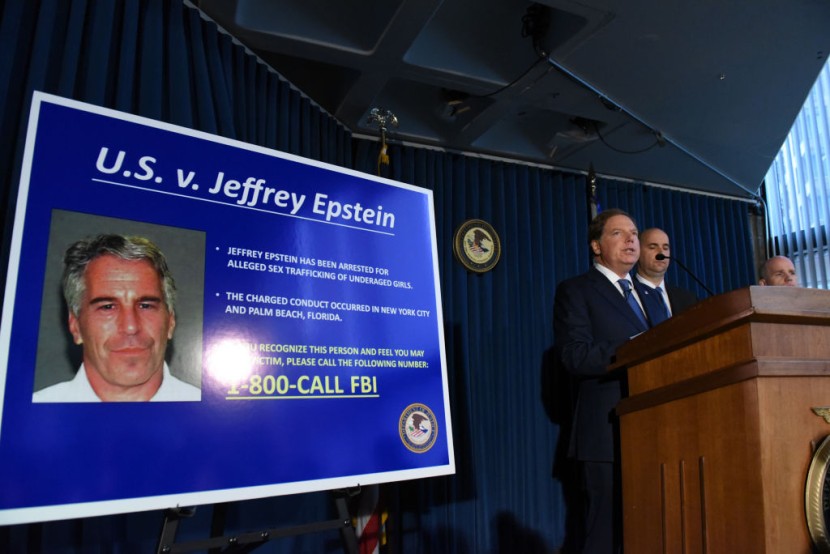

Deutsche Bank AG has agreed to pay $75 million to resolve a lawsuit brought by women who allege they were exploited by the late financier Jeffrey Epstein and who accuse the German bank of facilitating Epstein's sex trafficking.

The agreement resolves claims in a proposed class action filed by Epstein's accusers in Manhattan federal court, as verified by their attorneys late Wednesday. Court authorization is necessary.

Deutsche Bank to Settle Jeffrey Epstein Suit

Epstein was a client of Deutsche Bank between 2013 and 2018. In August 2019, while awaiting prosecution for sex trafficking, he committed suicide in a New York City jail, according to the city's medical examiner.

The Wall Street Journal reported the settlement earlier and cited sources familiar with the matter, saying the bank did not confess misconduct. Deutsche Bank spokesman Dylan Riddle declined to comment on the agreement but referred to a statement from 2020 in which the bank acknowledged that making Epstein a client was a mistake.

He also stated that Deutsche Bank had invested more than 4 billion euros in strengthening its controls, processes, and training and employing additional personnel to combat financial crime.

David Boies, one of the accusers' attorneys, stated that Epstein's transgressions were unacceptable and "could not have occurred without the collaboration and support of numerous influential people and institutions. We value Deutsche Bank's willingness to assume its responsibilities."

Per US News, Boies Schiller Flexner and Edwards Pottinger represent the accusers of Epstein. A trial was scheduled for September 5.

Read Also : Ukraine Claims It Shots Down 6 of Russia's Hypersonic Missiles During 'Exceptional' Attack on Kyiv

Deutsche Bank Allegedly Ignored Red Flags

The settlement, which a federal magistrate must approve, would end a proposed class-action lawsuit alleging that the bank enabled the disgraced financier's sex trafficking of young women by ignoring red flags in Epstein's accounts that he was engaging in illegal activity.

The restitution fund was established by Epstein's estate several months after he committed suicide while awaiting prosecution on sex trafficking charges. The fund has paid over $125 million to Epstein's victims, most of whom were adolescent females at the time of their abuse.

Additionally, the estate has paid approximately $20 million in settlements to victims who did not pursue restitution from the fund. The tentative settlement brings to a close the relationship between Deutsche Bank and Epstein, which began in 2013 and lasted until late 2018.

Epstein became a client of Deutsche Bank after his primary bank of approximately 15 years, JPMorgan Chase, ceased doing business with him. The attorneys for the victims have filed a lawsuit against JPMorgan, alleging that the bank ignored warning signals about Epstein and profited from his sex trafficking operation, NY Times reported.

JPMorgan has been sued by the government of the US Virgin Islands, the territory where Epstein operated his enterprises for nearly two decades. Epstein's estate consented to pay the Virgin Islands $105 million to resolve a lawsuit filed by the government to recover tax benefits awarded to one of Epstein's St. Thomas businesses.

Related Article : Elon Musk Subpoenaed Over JPMorgan's Jeffrey Epstein Ties