British Health Minister Neil O'Brien sought to reassure Thames Water customers, Thursday, June 29, over water bills and supply after the firm was reportedly on the brink of collapse. He said there were contingency plans in place to manage the situation.

"Absolutely nothing is going to happen in terms of either their bills or their access to water," he told Sky News.

The British government said Wednesday (June 28) it was ready to act should Thames Water collapse.

Thames Water Drowning in Debt

Thames Water is the largest water company in the UK and serves a quarter of the British population. It is currently in conversations about extra funding as it struggles to pay £14 billion ($17.72 billion) worth of debts. Interest payments on more than half of its debt are linked to the inflation rate, which soared over the last year.

In a statement, British water regulator Ofwat said Thames Water has "significant issues to address" and needed to improve its "financial resilience." The regulator noted the company still had access to its funds as it "recently received an additional £500m ($632.7 million) from shareholders" as well as £4.4 billion ($5.57 billion) of cash and committed funding.

"Ofwat will continue to keep companies' financial resilience under close scrutiny and work with companies to ensure they take action to ensure that they have the financial backing to deliver for customers and the environment," the statement added.

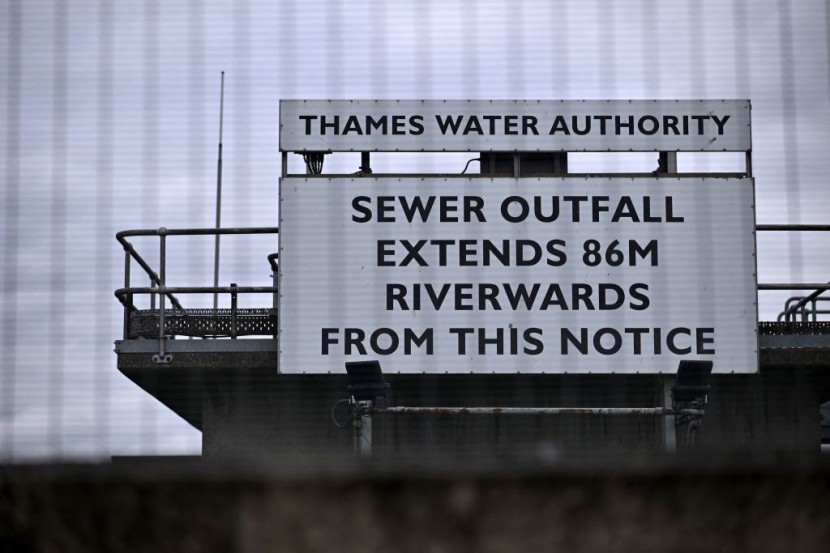

Thames Water has been heavily criticized in recent months over its performance after a series of sewage discharges and leaks, losing the equivalent of up to 250 Olympic size swimming pools every day from its pipes.

To make matters worse, the firm could be temporarily taken over by the government until a new buyer is found in a special administration regime if it could not secure additional funding. This was the case for energy supplier Bulb in 2021 after facing a similar situation.

House of Commons Business and Trade Committee chair Darren Jones (Labour-Bristol North West) also told the BBC that if the government was forced to take over the running of Thames Water, "taxpayers will be exposed to the debt and running costs of a very large company."

Earlier this week, Sarah Bentley stepped down as Thames Water CEO as a result of the mounting pressure for the company to fix its sewage problem. The firm did not give any comment about her departure.

Meanwhile, City veteran Sir Adrian Montague has been lined up as chairman for Thames Water as a replacement for Ian Marchant. Montague was previously made chairman of British Energy to find a solution when the nuclear power plant operator ran into financial problems in 2002.

A Flood of Financial Pressures

There are other water firms facing similar scenarios due to higher interest payments on their debts and rising costs, including higher energy and chemical prices.

Last year, Ofwat expressed its concern about the financial resilience of Yorkshire Water, SES, Southern, and Portsmouth Water, in addition to Thames Water.

A Southern Water representative told the BC its shareholders "continue to be supportive of the business and its financial resilience."

Water bills have been steadily increasing, with the annual bill for an average household in England and Wales hitting £448 ($567) in April.

Since water companies were privatized, there has been a steady flow of criticism of the amount of money paid to investors through dividends and to executives, given the companies' records on leaks and sewage discharges. Water companies have paid out £50.6 billion ($64.04 billion) in dividends between 1991 and 2021.

Parliament Environmental Audit Committee chair Philip Dunne (Conservative-Ludlow) said there was "no question" there were "excessive payments" to executives. "Revenue here arises as, of course, everybody turns on their taps and starts consuming water," he added.

Meanwhile, the Consumer Council for Water (CCW) said a "strong safety net" was needed to protect struggling households from any bill rises to fund investment.

"Nearly one in four households say they are currently struggling to pay their water bill amid the cost of living crisis, and this will add to their worries," added CCW senior director Mike Keil.

© 2026 HNGN, All rights reserved. Do not reproduce without permission.