China's commerce ministry announced Monday (July 3) it would control the exports of the metals gallium and germanium, which are mainly used in the semiconductor and electronics industry. The measure was a way of retaliating against a new set of restrictions imposed by the United States.

With this measure taking effect from August 1, exporters are required to seek permission to ship the raw materials overseas, including going through procedures to obtain export licenses.

Beijing's curbs would affect eight gallium-related products:

gallium antimonide

gallium arsenide

gallium metal

gallium nitride

gallium oxide

gallium phosphide

gallium selenide

indium gallium arsenide

It would also apply to six germanium products:

germanium dioxide

germanium epitaxial growth substrate

germanium ingot

germanium metal

germanium tetrachloride

zinc germanium phosphide

Anyone exporting the products without Chinese permission, as well as those who export in excess of the permitted volumes, would be punished.

China's curbs come just as US Treasury Secretary Janet Yellen was preparing to visit China later this week.

Global Reaction

In anticipation of rising prices for the raw materials, shares of Chinese Germanium producers skyrocketed Tuesday, which might ace at least a short-term supply disruption.

However, South Korean industry ministry and Taiwanese foreign ministry officials, Reuters reported, said the Chinese curbs would only have a little short-term impact. Reuters further reported the South Korean industry ministry official saying a possible expansion of curbs to include other materials could not be ruled out.

Last week, a fund backed by the Japanese government proposed a $6.3 billion acquisition of semiconductor materials giant JSR.

Meanwhile, the US and the Netherlands are also set to restrict further sales of chipmaking equipment from Chinese chipmakers this summer as part of efforts to prevent their technology from being used to strengthen the Chinese military.

What is Gallium?

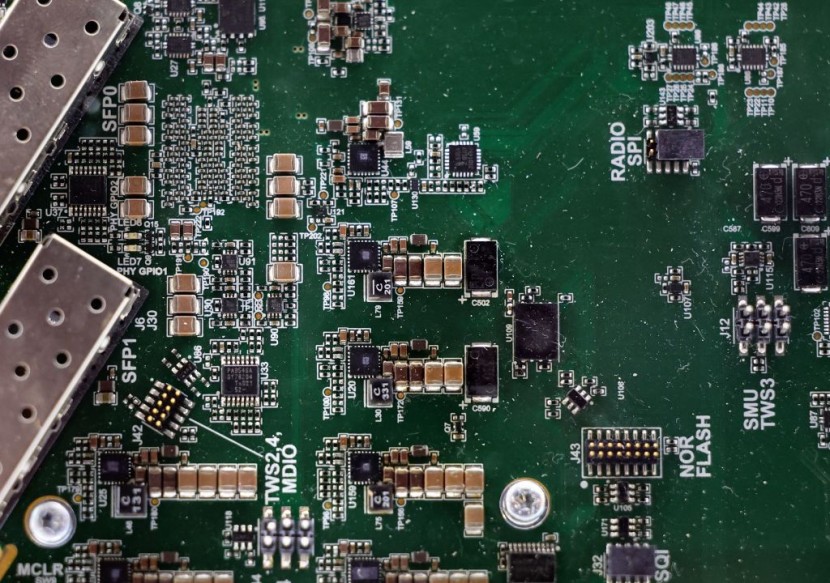

Gallium is a soft silver metal used to produce compound semiconductor wafers for electronic circuits, semiconductors, and light-emitting diodes (LEDs). It is found when processing bauxite to make aluminum.

According to the European Association Critical Raw Materials Alliance (CRMA), around 80% of the world's gallium is produced in China.

Gallium is also used to make gallium arsenide (GaAs) for use in electronics. Only a few companies could make such material at the required purity, the CRMA added. Most of these companies are in Japan and China, with only a single facility capable of this technology in Europe.

Semiconductor wafers made with GaAs instead of silicon can operate at higher frequencies and are heat resistant, said the US company Wafer World. GaAs semiconductors also produce less noise than silicon devices, especially at high operating frequencies, making them useful in radars and radio communication devices, as well as in satellites, the company added.

According to Chinese customs, the country exported 94 metric tons of gallium in 2022.

US imports of gallium metal and GaAs wafers in the same year were worth about $3 million and $200 million, respectively, according to the US Geological Survey (USGS).

Shanghai Metal Exchange data on Refinitiv Eikon showed gallium with a 99.99% purity produced in China priced at $245 a kilogram on Monday (July 3), an increase of 5.97% from the previous session and the highest since May 16.

What is Germanium?

Germanium is used in semiconductors, infrared technology, fiber optic cables, and solar cells. It is a rare ore, most of which is produced as a by-product of zinc production and from coal fly ash.

China alone produces around 60% of the world's germanium, according to CRMA. According to Chinese customs, the country exported 43,7 metric tons of unwrought and wrought germanium last year.

In addition, germanium and its oxides are used in military applications like night-vision devices and satellite imagery sensors.

China's germanium ingot price was last assessed at $1,264 per kilogram Monday, according to Refinitiv Eikon's data on the Shanghai Metal Exchange.

Which Countries Produce Gallium and Germanium?

While China has the most prominent and most voluminous production of gallium and germanium, several countries are also capable of producing the raw materials.

According to Reuters, 40% of the world's germanium came from Canada, Finland, Russia, and the United States.

Meanwhile, 20% of the world's gallium can be found in Japan, Russia, and South Korea. Germany and Kazakhstan also produced the material in the past. After prices rallied in 2020 and 2021, Germany announced it would restart its primary gallium production.

Why Does China Stop Exporting Metals Gallium and Germanium?

China made the decision as the country faces an escalated trade war with the US, saying it was aimed at protecting its national security and interests.

Beijing's move came as Washington mulled new restrictions on the shipment of high-tech microchips to China, according to media reports.

In a press conference in Beijing Tuesday (July 4), Chinese Ministry of Foreign Affairs spokesperson Mao Ning reiterated the country's export controls were in accordance with the law and were not targeted at any specific capacity.

This was not the first time China restricted export quotas of raw materials.

In 2010, the country restricted rare earth exports to Japan following a territorial dispute between the countries, sending prices of rare earth materials soaring and Japan scrambling to find other sources of supply. At that time, Beijing reasoned the curbs were based on environmental concerns.

Rare earth magnets are used in wind turbines, electric vehicles, and laser-guided missiles.

What Will Happen When China Stops Exporting Gallium and Germanium?

Since China is the world's largest source of both metals, as per a European Union Study on critical raw materials this year, Eurasia Group analysts, Anna Ashton, Xiaomeng Lu, and Scott Young said the move would have a "limited impact" on global supply, given the targeted scope.

"It is a shot across the bow intended to remind countries including the United States, Japan, and the Netherlands that China has retaliatory options and to thereby deter them from imposing further restrictions on Chinese access to high-end chips and tools," they added.

However, the analysts also noted that China alone could be able to manage "extensive and increasingly integrated mining and processing operations" alongside state subsidies. This allowed them to "export processed minerals" at a cost that operators elsewhere could not match, which perpetuates the country's market dominance for many critical commodities.

Related Article: US-China Chip War Heats Up as Dutch Join Restrictions

© 2025 HNGN, All rights reserved. Do not reproduce without permission.