The United States Supreme Court seemed hesitant when hearing arguments of a Constitutional challenge that seeks to upend the Consumer Financial Protection Bureau (CFPB).

The legal challenge aims to have the agency, set up to protect consumers from predatory lenders and other unlawful financial service practices, funded with annual appropriations, which Congress approves. Currently, the agency is funded directly by the Federal Reserve.

Constitutional Challenge Against the CFPB

The challenge was issued by two trade groups that represent lenders and argue that the agency being funded by the Federal Reserve is unconstitutional. In response to the challenge, the government argued that Congress often uses a similar approach to fund large spending programs, including Social Security.

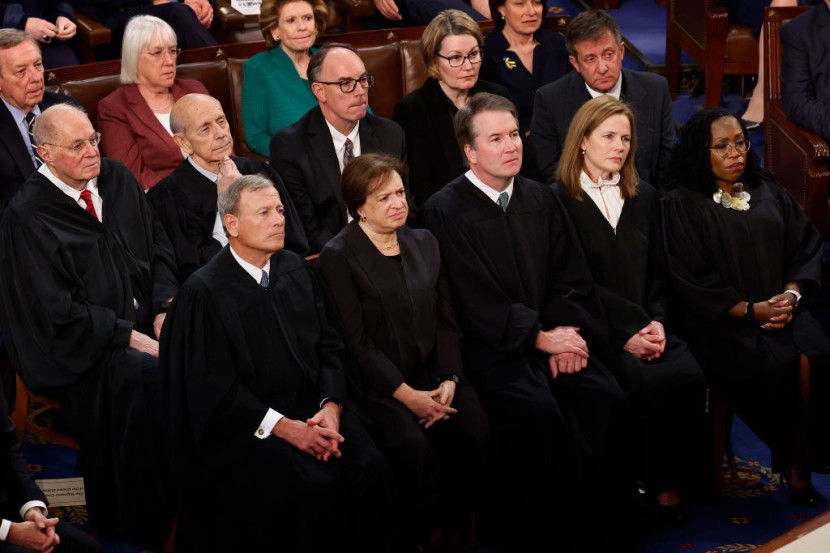

Conservative Supreme Court Justice Brett Kavanaugh pushed back on the notion that the CFPB has been giving funding in perpetuity. As per Yahoo News, he noted that Congress always has the authority to intervene to amend the funding scheme.

Justice Amy Coney Barrett, another conservative in the Supreme Court, also appeared skeptical that the Constitution's appropriation clause, which states that the government cannot spend money without congressional authorization, prohibits Congress from implementing different types of funding schemes.

She said that nothing in the clause itself imposed the limits that the plaintiffs were talking about in their case. In particular, liberal Justice Elena Kagan was scathing about Noel Francisco's argument, adding that Congress has long approved open-ended funding for various agencies.

Kagan told Francisco, the lawyer representing the challengers in the case, that they are just "flying in the face of 250 years of history." The government also argued that a ruling against the CFPB would cast legal doubt on funding other government entities, including the Federal Reserve itself and the Federal Deposit Insurance Corp.

Read Also: Federal Judge Blocks Provisions of North Carolina Near-Total Abortion Ban, Favors Advocacy Groups

Supreme Court Justices Hesitant

The case against the CFPB marks one of the biggest legal threats to the federal agency since its inception, which happened just over a decade ago. The CFPB was first envisioned by Democratic Sen. Elizabeth Warren and was established as part of the Dodd-Frank Wall Street reform law, according to The Hill.

For some time, Republicans have lamented that the funding mechanism means that Congress has little control over the independent agency. Additionally, the trade association's argument received skepticism even from conservative Justice Clarence Thomas.

He said that while he understands that the situation with the CFPB is different and unique, he noted that it does not point to a constitutional problem. Thomas said that the situation could be a problem with analogs, which he argued does not prove the plaintiffs' case.

This is not the first time the CFPB faced a legal challenge, with one occurring in 2018 when the Community Financial Services Association of America and the Consumer Service Alliance of Texas sued the federal agency. They sought to throw out a regulation cracking down on payday loans.

At the time, a federal judge ruled in favor of the CFPB after it modified a regulation that barred lenders from repeatedly seeking to withdraw loan repayments from a consumer's bank account if they do not have sufficient funds, said NBC News.

© 2025 HNGN, All rights reserved. Do not reproduce without permission.