The Federal Deposit Insurance Corporation's watchdog has confirmed additional workplace misconduct inquiries following harassment reports, including the toxic environment.

The FDIC's inspector general's office noted that they will perform a special inquiry into the leadership climate at the FDIC concerning all forms of harassment and inappropriate behavior.

FDIC Watchdog Confirms Additional Misconduct Inquiries

The inspector general will also assess the FDIC's sexual harassment prevention program as part of the additional misconduct inquiries. An inspector general said an official announcement would be released once planning was complete.

The FDIC launched an independent probe by the law firm BakerHostetler after The Wall Street Journal's comprehensive reporting on workplace misconduct allegations.

Furthermore, FDIC also established a special panel to manage the third-party review of the regulator's working environment, which will be co-chaired by FDIC director Jonathan McKernan and Michael Hsu, the acting chair of the Office of the Comptroller of the Currency.

McKernan and Hsu stated that the FDIC board has been committed to fostering an environment and culture that promotes a safe, fair, and inclusive workplace for all FDIC employees.

They added that the board would support taking all actions necessary to identify and address the problem's root cause and promote accountability.

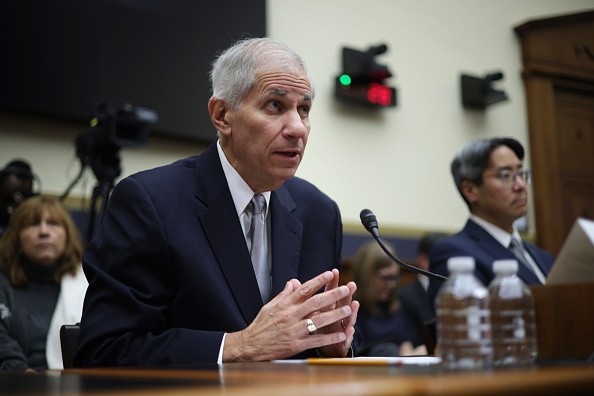

The House Oversight Committee's Subcommittee performed an investigation, requesting the FDIC to share records of sexual harassment complaints within the agency and official responses to these submissions. FDIC Chair Martin Gruenberg confirmed that he would not oversee the investigations.

McClain and Biggs wrote a letter to Gruenberg, saying that the reports by The Wall Street Journal described an abusive culture of sexual harassment and discrimination within the FDIC and a lack of internal investigation, encouraging reporting and effective responses to such allegations.

The reports noted that GOP representatives and senators called for Gruenberg's resignation. The calls for his resignation escalated after his testimony, which shows that Gruenberg had never been investigated for inappropriate behavior or participated in such conduct, which conflicted with media reports.

"Notwithstanding the toxic environment over which you presided in some leadership capacity over the last 18 years, your conflicting testimony in this week's hearing before the Committee was alarming," Rep. Patrick McHenry, House Financial Services Committee chair, said in a letter co-authored by other GOP committee members.

Sen. Joni Ernst requested that individuals found guilty of misconduct be given serious consequences, including termination and criminal prosecution when warranted.

Ernst was angry and disgusted with the allegations and added that the appointment of a special committee was too late.

Read Also : 'Squad' Votes on Reaffirming Israel's Rights to Exist, Demands Hamas to Release Remaining Hostages

FDIC 'Boys Club' Culture

In The Wall Street Journal's reporting, the FDIC culture was described as a 'boys club' and reported that bank examiners who engaged in misogynistic behavior faced minor consequences.

The harassment reports in the office have been increasing, which resulted in women leaving FDIC. The report also included Gruenberg maintaining a fierce temper and doing nothing in response to complaints.

Furthermore, there were racism allegations in the workplace. In 2018, an anonymous group of black employees expressed concerns to then-Chair Jelena McWilliams that they were mistreated and were afraid to speak out about the issues they were facing for fear of repercussions.

In 2020, the FDIC passed 15 recommendations to prevent and respond to sexual harassment. However, Gruenberg admitted that they failed to change the culture.