Mississippi State Treasurer David McRae has joined 22 other state financial officials in rejecting President Joe Biden's plan, which they claim would give the IRS access to more than 100 million Americans' private banking activities.

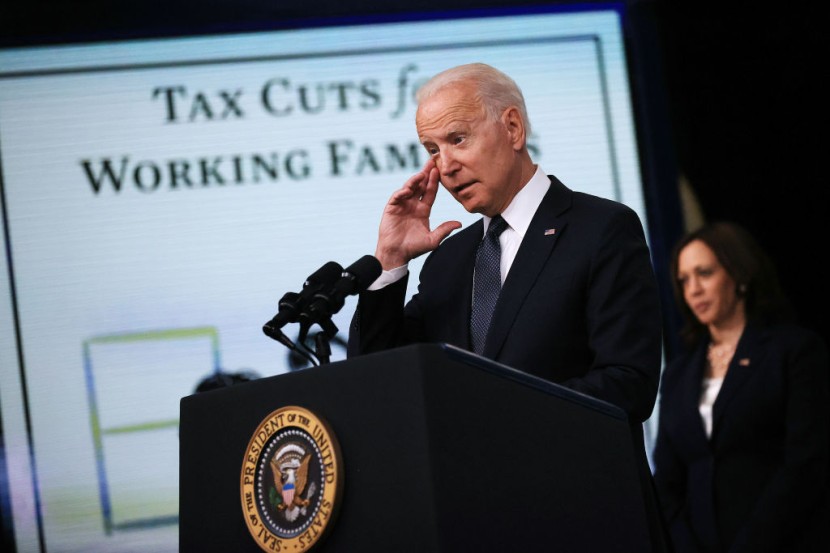

The American Families Plan is the proposal in dispute. The measure includes financing for free pre-school for three and four-year-olds, two years of free community college, and extra investments to offer four-year education to poor and middle-income Americans, according to the White House.

The plan also includes direct assistance to families to help with childcare expenses, creating a national paid family and medical leave program, and the extension of tax cuts for low and middle-income employees that were enacted as part of the American Rescue Plan.

Is Biden's plan a way to spy your bank activities?

Aside from such measures, the State Financial Officers Foundation said the plan's tax compliance standards represent the "largest data-mining exercise in US history," as per WTOK. The idea would allocate an additional $80 billion to the IRS over the next decade to upgrade technology and recruit more agents to assure compliance.

Efforts would also be made to close what the Biden administration refers to as the "tax gap," or the difference between the amount of federal taxes paid each year voluntarily and the amount owing.

In a news statement, McRae said that if the plan is passed, the IRS may monitor the private banking activities of more than 100 million Americans. The objective of permitting this invasion of privacy is to target those who do not pay their total income tax to raise a huge quantity of money to support the administration's $3.5 trillion spending proposal.

The IRS monitoring proposal was initially presented in May 2021, and it is now being discussed as part of the $3.5 trillion spending package presently being considered in the United States Congress. While no concrete legislation has been submitted at this time, opponents of the plan in the US House and Senate are concerned that it might be presented by Democratic leadership at any time, as per Y'all Politics.

Read Also : COVID-19 Vaccine Apartheid: African Leaders Condemn Disparity in United Nations General Assembly

State leaders fight against potential IRS monitoring of bank accounts

If the idea is passed, Utah State Auditor John Dougall and State Treasurer Marlo Oaks believe the IRS may examine the private financial activities of more than 100 million Americans.

Financial institutions would be obliged to disclose gross inflows and withdrawals from all corporate and personal accounts to the IRS once a year if the sums total at least $600.

Only total amounts of money flowing into and out of an account during the previous year would be reported by banks and credit unions. They wouldn't have to record the specifics of each transaction.

The Treasury Department announced the idea in May. It may be adopted as part of budget reconciliation legislation presently being considered by the Senate Finance and House Ways and Means committees.

The new reporting requirements, according to Oaks, are an "unprecedented infringement" on Americans' rights and privacy. This week, the State Financial Officers Foundation wrote to President Joe Biden and Treasury Secretary Janet Yellen, describing the idea as a "direct assault" on all Americans and companies, regardless of economic position.

According to the group in which Dougall serves as an auditor at large, there is no evidence that the proposal will assist collect taxes from tax evaders. It also claims that the proposal lacks protections to prevent the IRS or other government agencies from misusing the data, Deseret reported.

Related Article : Joe Biden's Approval Rating Slumps; Voters Think The President is Mentally Incapable, Has Bad Immigration Policy